Financial & Business News

LATEST INVESTING HEADLINES

I expect OptimizeRx to turn profitable in 2025, driven by strong double-digit revenue growth and reduced operating expenses. The company's proprietary AI-powered omnichannel platform connects over 2 million healthcare providers with millions of patients, enabling effective targeted marketing. OPRX's unique Dynamic Audience Activation Platform and Micro-Neighborhood Targeting differentiate it from competitors and support its patient-centered strategy.

David Dietze says "Tesla is going to be tough" when it comes to expecting an earnings beat next week. He points to declining sales and rising EV competition in China as potential headwinds.

Return of Snack Wraps leaves some locations temporarily short of ingredients as brisk sales come after tough stretch for burger giant

SLB CEO Olivier Le Peuch joins CNBC's "Power Lunch" team to discuss the company's latest earnings report, oil markets and more.

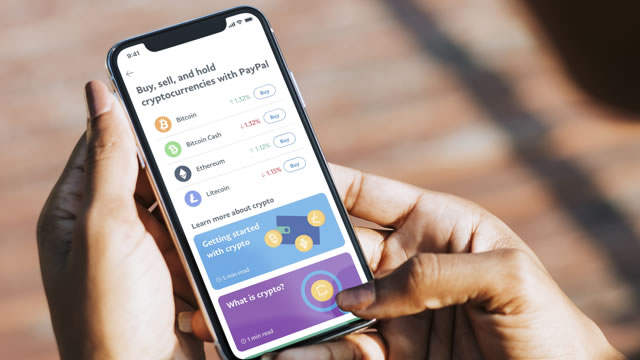

Key Points in This Article: Bitcoin (BTC) and XRP (XRP) represent opportunities for investors to turn a modest investment into millions, but which is likely to succeed? BTC’s strength as digital gold, driven by institutional adoption and ETF inflows, contrasts with XRP’s utility in Ripple’s cross-border payment solutions and tokenized asset ecosystem. Regulatory developments and the Trump administration’s crypto-friendly policies are key factors influencing both assets’ long-term wealth-building potential. Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more. Crypto investors today face a critical choice. They can ride the towering momentum of Bitcoin (CRYPTO:BTC), the market’s dominant cryptocurrency, or invest in the utility-driven potential of XRP (CRYPTO:XRP) to deliver life-changing, millionaire-making returns. While both assets hold promise, which is more likely to transform a modest

NEW YORK, July 18, 2025 (GLOBE NEWSWIRE) -- WHY: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of GeneDx Holdings Corp. (NASDAQ: WGS) resulting from allegations that GeneDx may have issued materially misleading business information to the investing public.

Exxon Mobil has lost its arbitration challenge to block Chevron's $55 billion Hess acquisition deal, but the top U.S. oil producer managed to delay the tie-up by over a year, costing its rival billions in lost Guyana oil revenue and slowing integration.

Shares of Sarepta Therapeutics fell close to 37% on Friday after reports emerged that the US Food and Drug Administration is considering whether to halt the distribution of Elevidys, the company's flagship gene therapy for Duchenne Muscular Dystrophy (DMD).

German insurer Allianz has formed an equally-owned reinsurance joint venture in India with Reliance Group-owned Jio Financial Services , expanding its presence in the country's insurance market, the companies said on Friday.

Tech giant PayPal Holdings Inc. NASDAQ: PYPL has frustrated investors over the past few years. Despite being one of the pandemic's standout winners, the stock has essentially traded flat for the better part of three years since losing 80% of its value.