Financial & Business News

LATEST INVESTING HEADLINES

MURFREESBORO, TN / ACCESS Newswire / May 5, 2025 / National Health Investors, Inc. (NYSE:NHI) announced today that it will pay its second quarter dividend of $0.90 per common share on August 1, 2025, to stockholders of record as of June 30, 2025. About NHI Incorporated in 1991, National Health Investors, Inc. (NYSE: NHI) is a real estate investment trust specializing in sale, leasebacks, joint-ventures, senior housing operating partnerships, and mortgage and mezzanine financing of need-driven and discretionary senior housing and medical investments.

AUSTIN, Texas and NEW YORK, May 05, 2025 (GLOBE NEWSWIRE) -- T1 Energy Inc. (NYSE: TE) (“T1,” “T1 Energy,” or the “Company”) announced this afternoon that the Company will publish a press release detailing first quarter 2025 results and conduct a conference call on May 15, 2025.

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

Ernest Hoffman is a Crypto and Market Reporter for Kitco News. He has over 15 years of experience as a writer, editor, broadcaster and producer for media, educational and cultural organizations.

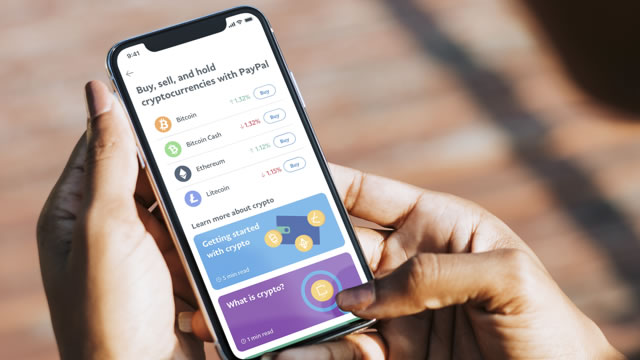

PayPal Holdings is a solid fintech investment with potential for growth, driven by increasing active accounts and improving transaction margins. The company reported $1.33 per share in non-GAAP profits for 1Q25, exceeding estimates, and reaffirmed its profit forecast for 2025. Positive trends in operating and transaction margins, coupled with a low valuation compared to peers, support a bullish outlook for PayPal.

Delivers lower-than-expected sales amid a challenging and volatile consumer and geopolitical environment while maintaining overall market shares and delivering its 10th consecutive quarter of gross margin expansion OAKLAND, Calif. , May 5, 2025 /PRNewswire/ -- The Clorox Company (NYSE: CLX) today reported results for the third quarter of fiscal year 2025, which ended Mar. 31, 2025.

PORTLAND, Tenn., May 05, 2025 (GLOBE NEWSWIRE) -- Shoals Technologies Group, Inc. (Nasdaq: SHLS), a global leader in electrical balance of system (EBOS) solutions for the energy transition market, announced today the execution of a Memorandum of Understanding (MOU) with UGT Renewables to collaborate on up to 12 gigawatts (GW) of global solar projects currently in UGT Renewables' development pipeline.

LA JOLLA, Calif., May 05, 2025 (GLOBE NEWSWIRE) -- Palomar Holdings, Inc. (NASDAQ:PLMR) (“Palomar” or “Company”) reported net income of $42.9 million, or $1.57 per diluted share, for the first quarter of 2025 compared to net income of $26.4 million, or $1.04 per diluted share, for the first quarter of 2024. Adjusted net income(1) was $51.3 million, or $1.87 per diluted share, for the first quarter of 2025 as compared to $27.8 million, or $1.09 per diluted share, for the first quarter of 2024.

NEW YORK , May 5, 2025 /PRNewswire/ -- IAC (NASDAQ: IAC) posted its first quarter financial results on the investor relations section of its website at https://ir.iac.com/quarterly-results. As announced previously, IAC will host a conference call to discuss the company's first quarter results and to answer questions.

EASTON, PA / ACCESS Newswire / May 5, 2025 / Paragon Technologies, Inc. (OTC PINK:PGNT) Dear Stockholder: On April 29, 2025, Hesham M. Gad commenced a consent solicitation to remove all the current directors of Paragon other than himself and replace them with his handpicked nominees.