Financial & Business News

LATEST INVESTING HEADLINES

NEW YORK, Sept. 06, 2025 (GLOBE NEWSWIRE) -- Pomerantz LLP announces that a class action lawsuit has been filed against Biohaven Ltd. (“Biohaven” or the “Company”) (NYSE: BHVN) and certain officers. The class action, filed in the United States District Court for the District of Connecticut, and docketed under 25-cv-01120, is on behalf of a class consisting of all persons and entities other than Defendants that purchased or otherwise acquired Biohaven securities between March 24, 2023 and May 14, 2025, both dates inclusive (the “Class Period”), seeking to recover damages caused by Defendants' violations of the federal securities laws and to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 sand Rule 10b-5 promulgated thereunder, against the Company and certain of its top officials.

Google, now part of Alphabet (NASDAQ: GOOG), was founded in 1988 by Sergey Brin and Larry Page.

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses In Centene To Contact Him Directly To Discuss Their Options If you purchased or acquired securities in Centene between December 12, 2024 and June 30, 2025 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310). [You may also click here for additional information] NEW YORK , Sept.

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses In Unicycive To Contact Him Directly To Discuss Their Options If you purchased or acquired securities in Unicycive between March 29, 2024 and June 27, 2025 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310). [You may also click here for additional information] NEW YORK , Sept.

Legacy Housing remains a soft 'buy' due to strong revenue growth, driven by higher unit sales and increased average pricing. Texas is a key market, with expansion at Falcon Ranch promising further revenue upside as additional lots are developed. Despite a dip in net income, cash flow and EBITDA improved, and the company's net cash position provides resilience in a tough housing market.

CoreWeave offers strong short-term upside due to rapid AI infrastructure revenue growth and a robust sales backlog, making it a compelling momentum play. Despite impressive revenue growth, CoreWeave faces significant risks from customer concentration, heavy debt, and high interest expenses impacting profitability. The company's valuation could double by 2027 if growth projections are met, but long-term sustainability is uncertain without improved capital structure and diversification.

The global economy is navigating two powerful currents. The first is a worldwide push for reliable, carbon-free, renewable energy, bringing nuclear power back into the spotlight.

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses in iRobot To Contact Him Directly To Discuss Their Options If you purchased or acquired securities in iRobot between January 29, 2024 and March 11, 2025 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310). [You may also click here for additional information] NEW YORK , Sept.

Prologis offers a stable debt profile, strong liquidity, and a healthy, growing dividend, making it attractive for long-term investors despite near-term headwinds. Share price growth has lagged e-commerce demand, but easing rates and supply chain reshoring could drive future upside and total return potential. Dividend yield is expected to hover around 3.5%, supported by consistent dividend growth and robust FFO, with manageable payout and refinancing risk.

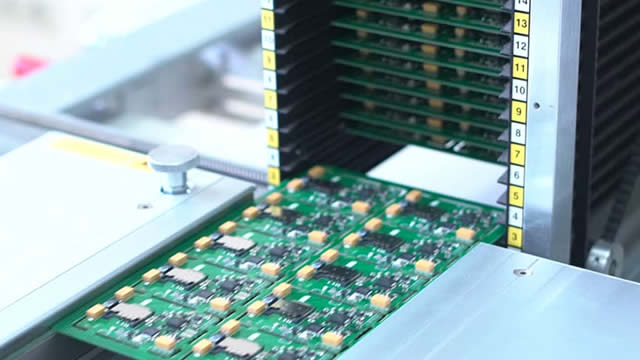

Marvell is transforming into a pure-play AI data center enabler, reallocating resources to high-growth custom silicon and interconnect verticals. The company is uniquely positioned to benefit from hyperscalers' need for custom chips, leveraging its deep IP and design expertise. Despite a premium valuation, Marvell's rapid revenue growth and expanding margins set up an asymmetric long-term opportunity.