Financial & Business News

LATEST INVESTING HEADLINES

Citron Research, led by famed short-seller Andrew Left , targeted Opendoor Technologies, Inc. OPEN in a social media post on Friday. Opendoor investors shrugged off the attack, and the stock climbed.

Candel Therapeutics' CAN-2409 shows robust, multi-cancer efficacy with significant survival gains in prostate, pancreatic, and lung cancers, plus promising early glioblastoma data. The company is financially solid after a $92 million capital raise, ensuring a cash runway through 2027 and supporting late-stage clinical and regulatory milestones. Candel's differentiated oncolytic viral platform and FDA Fast Track designations position it as a leader in a rapidly maturing immuno-oncology niche.

Shares of Advanced Micro Devices (AMD -5.48%) were taking a dive today in response to an analyst downgrade, calling out weakness in its artificial intelligence (AI) division.

Unfortunately, you won't earn high yields with today's savings accounts. So, if it's dependability you're after, with yield to boot, you can't go wrong with a safe ETF.

Transaction in Own Shares 5 September, 2025 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 5 September, 2025 it purchased the following number of Shares for cancellation. Aggregated information on Shares purchased according to trading venue: Date of purchase Number of Shares purchased Highest price paid Lowest price paid Volume weighted average price paid per share Venue Currency 05/09/2025 677,502 £26.9200 £26.2600 £26.5329 LSE GBP 05/09/2025 172,529 £26.9200 £26.4100 £26.7040 Chi-X (CXE) GBP 05/09/2025 398,676 £26.9200 £26.2650 £26.5063 BATS (BXE) GBP 05/09/2025 801,058 €31.2050 €30.4050 €30.7289 XAMS EUR 05/09/2025 348,691 €31.2100 €30.4750 €30.8728 CBOE DXE EUR 05/09/2025 - - - - TQEX EUR These share purchases form part of the on- and off-market limbs of the Company's existing share buy-back programme previously announced on 31 July 2025.

Toronto, Ontario--(Newsfile Corp. - September 5, 2025) - Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint" or the "Company") announces the closing of the final tranche of its previously announced private placement (the "Private Placement") comprising of a combination of: 5,768,824 Saskatchewan charity flow through units (the "SK Flow Through Units") at a price of $0.65 per unit for aggregate gross proceeds of $3,749,735.60; and 3,041,295 National charity flow through units (the "NT Flow Through Units", together with the SK Flow Through Units, the "Flow Through Units") at a price of $0.59 per unit for aggregate gross proceeds of $1,794,364.05. "This final tranche not only completes our raise but strengthens our alignment with IsoEnergy and reinforces our shared commitment to long-term uranium discovery in the Basin," said Chris Frostad, President & CEO of Purepoint.

GE Aerospace teams up with BETA to develop hybrid electric turbogenerators, aiming to boost range, payload and performance in next-gen aircraft.

Aquestive Therapeutics's Anaphylm could be the first FDA-approved, non-invasive, orally delivered epinephrine for anaphylaxis, with a PDUFA date set for January 2026. FDA's decision not to convene an advisory committee is a positive signal, and clinical data seems to strongly support Anaphylm's safety and efficacy. If approved, Anaphylm could capture significant market share, potentially driving Aquestive's valuation above $1bn and offering >50% upside for investors.

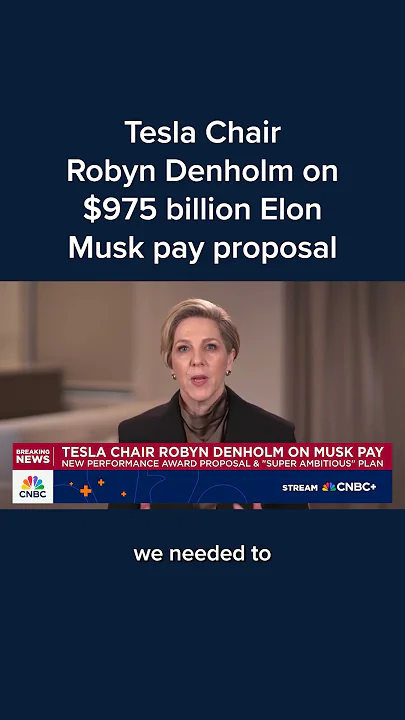

Tesla is asking investors to approve yet another outsized pay plan for CEO Elon Musk, according to a financial filing out Friday. The total package is worth about $975 billion based on the maximum payout.

AOD offers global equity exposure and a high 13.2% yield, but inconsistent distribution coverage raises sustainability concerns. The fund trades at its smallest discount to NAV in a decade, making current valuations less attractive for new accumulation. AOD underperforms traditional ETFs in total return due to its income-focused strategy and reliance on selling gains for payouts.