AAP Stock Recent News

AAP LATEST HEADLINES

Advance Auto Parts (AAP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

While both companies have faced headwinds in recent years, Advance Auto Parts (AAP) and Ford (F) stock could be in store for a sharp rebound at some point.

RALEIGH, N.C.--(BUSINESS WIRE)--Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive aftermarket parts provider in North America that serves both professional installers and do-it-yourself customers, will report financial results for its first quarter ended April 19, 2025, before the market opens on Thursday, May 22, 2025. The company has scheduled a conference call and webcast to begin at 8:00 a.m. ET on Thursday, May 22, 2025. A live webcast will be available on the company's Investor R.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

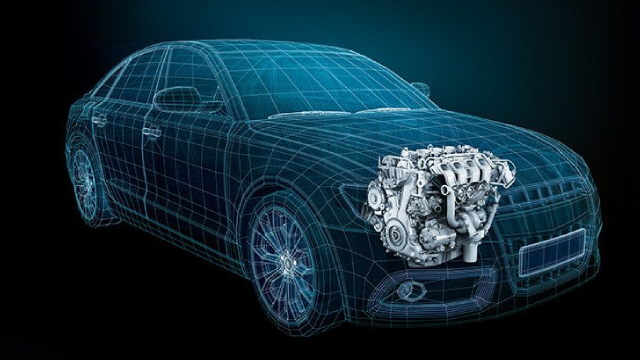

Auto part retailers like AZO, GPC & AAP are set to benefit from rising demand for replacement parts and expansion efforts.

The new economic environment has shifted to a new view lately, especially as the implications of new trade tariffs rolled out by President Trump start to take effect on both the psychology and budget of the consumer. More than that, business owners and managers are now starting to make buying decisions based on the potential impact of these tariffs as well.

Advance Auto Parts (AAP) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Advance Auto Parts NYSE: AAP stock can rebound in 2025. The company is working hard to simplify its structure and reposition itself for sustainable, profitable growth centered on improving store metrics and aggressively increasing store count.

Advance Auto Parts (AAP) reported earnings 30 days ago. What's next for the stock?

Tariffs and tech take Joe Tigay's focus on today's Big 3. He talks about why Alphabet (GOOGL) is a buy despite its pullback, Advance Auto Parts' (AAP) rally after the auto tariffs announcement and how Amazon (AMZN) is at the "crossroads" between the American consumer and A.I.