AAPL Stock Recent News

AAPL LATEST HEADLINES

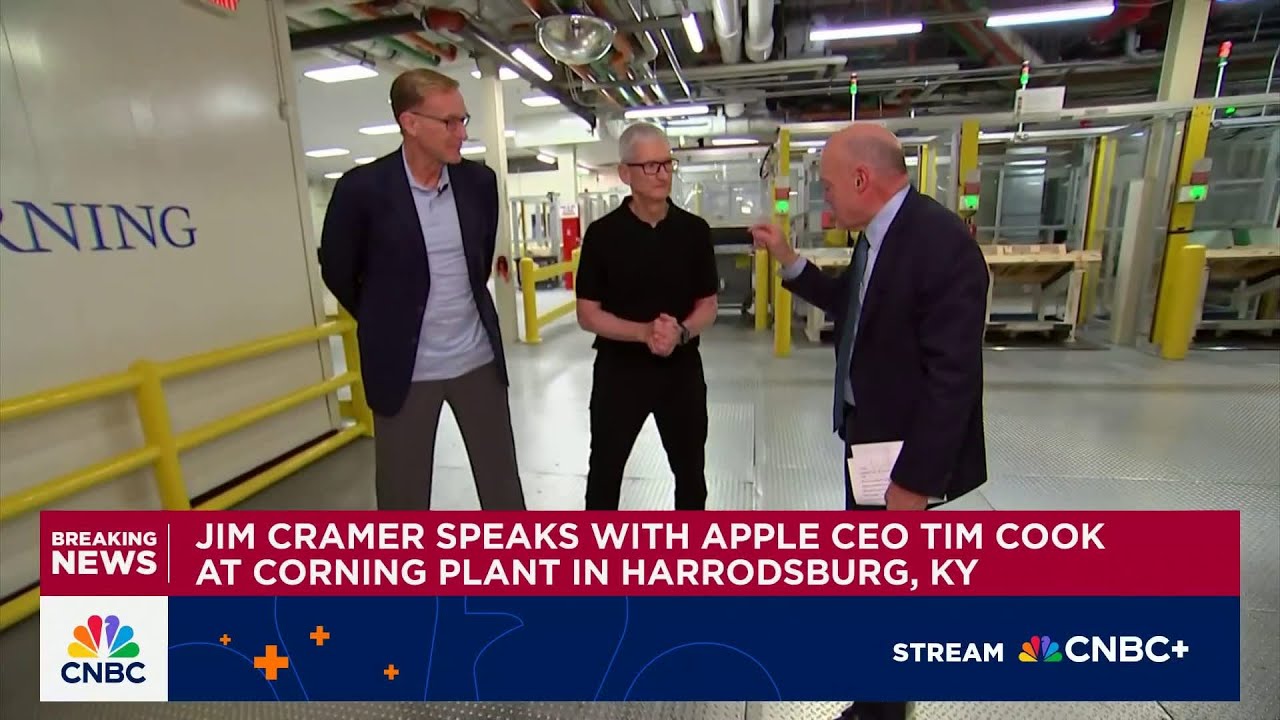

Jim Cramer talks with Apple CEO Tim Cook and Corning CEO Wendell Weeks at Corning's Kentucky facility.

Apple postponed the launch of the iPhone Air in mainland China due to its eSIM design. Wireless carriers in China must obtain regulatory approval before they can sell devices with an eSIM, the company said.

Jim Cramer joins 'Squawk on the Street' from Corning's Kentucky facility and talks with Apple CEO Tim Cook about what's new in Apple's latest iPhone lineup.

Nvidia Corp. NVDA has dramatically outperformed the Magnificent 7 (Mag 7) group since late 2022, surging over 475% in relative performance, buoyed by several catalysts. While peers like Apple Inc AAPL and Tesla Inc TSLA have lagged, Nvidia's gains have reshaped the tech landscape, turning it from a niche player to the group's heavyweight.

The company is awaiting regulatory approval for its new, thinner iPhone model in its second-largest market.

Apple Inc. was hit with a pair of downgrades on Thursday, in the latest sign of caution toward the iPhone maker, a day after revealing the new lineup of iPhones. One analyst says the new products "left us uninspired.

A page on Apple's Chinese site says iPhone Air ‘release information will be updated later.'

On Tuesday at the “Awe Dropping” event, Apple Inc. AAPL unveiled its iPhone 17 lineup.

Apple will roll out a hypertension detection feature on its smartwatch next week after receiving U.S. Food and Drug Administration (FDA) clearance on Thursday, Bloomberg News reported.

The Dow Jones Industrial Average (^DJI 1.31%) rose 3.2% in August 2025, comfortably ahead of the broader S&P 500 (^GSPC 0.81%) index, which gained 1.9% in the same period. But the Dow's impressive performance was built on a mixed bag of specific stock performances.