ABB Stock Recent News

ABB LATEST HEADLINES

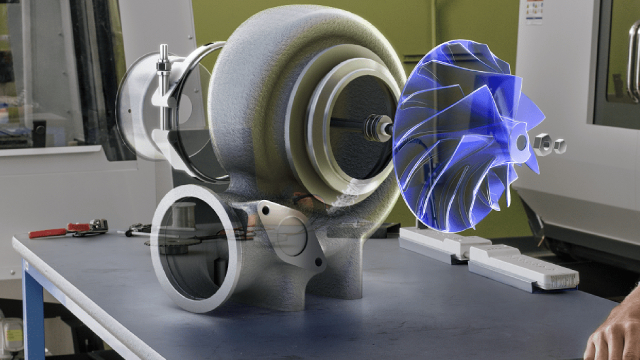

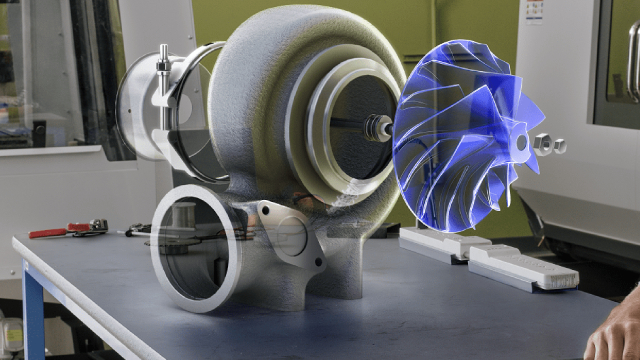

ABB is transforming into a high-quality electrification and infrastructure platform, with growth driven by grid, datacenter, and renewables demand. Record backlog and strong order flow provide multi-year revenue visibility, shifting ABB away from short-cycle industrial volatility toward long-term, programmatic growth. Margin profile is structurally improving, with Electrification and Motion leading; the 2026 Robotics spin-off will further enhance profitability and portfolio quality.

ABBNY's Electrification segment surges in Q2 with record backlog and rising orders, fueled by data centers and key acquisitions.

ABB Ltd (OTCPK:ABBNY) Q2 2025 Earnings Conference Call July 17, 2025 4:00 AM ET Company Participants Ann-Sofie Nordh - Group Senior VP & Head of Investor Relations Morten Wierod - Chief Executive Officer Timo J. Ihamuotila - Chief Financial Officer Conference Call Participants Alasdair Leslie - Sanford C.

ABBNY's Motion segment drives growth with strong backlog and margin gains, despite softer orders and end-market demand.

ABBNY's Electrification segment gains momentum with record backlog and strong orders despite weakness in China.

ABBNY trades near its 52-week high after strong segment growth, but high debt and valuation may warrant investor caution.

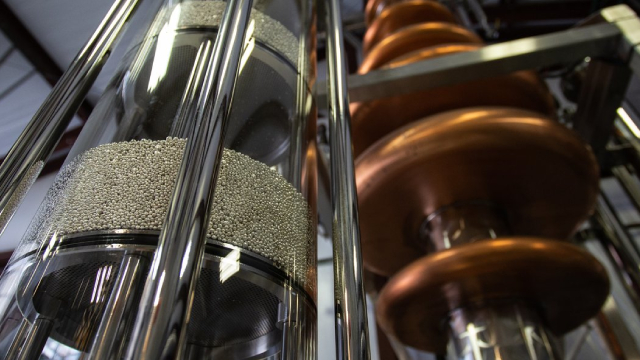

ABBNY's Process Automation segment sees 23% order growth as the marine, ports and energy industries fuel momentum.

Italian asset manager Banca Mediolanum said on Monday it had begun the sale of its entire 3.5% stake in merchant bank Mediobanca via an accelerated bookbuilding process.

Here is how ABB (ABBNY) and Kone Oyj Unsponsored ADR (KNYJY) have performed compared to their sector so far this year.

Applied Digital, a builder and operator of next-generation data centers, has launched an infrastructure partnership with ABB at the company's greenfield 400 MW campus in North Dakota, United States. The collaboration will innovate fast, reliable, energy-efficient solutions to meet the needs of rapidly advancing artificial intelligence (AI) capabilities. As part of this long-term partnership, the first orders were booked in Q4 2024 and Q1 2025. Further financial details of the partnership were not disclosed.