ABB Stock Recent News

ABB LATEST HEADLINES

ABBNY's Process Automation segment sees 23% order growth as the marine, ports and energy industries fuel momentum.

Italian asset manager Banca Mediolanum said on Monday it had begun the sale of its entire 3.5% stake in merchant bank Mediobanca via an accelerated bookbuilding process.

Here is how ABB (ABBNY) and Kone Oyj Unsponsored ADR (KNYJY) have performed compared to their sector so far this year.

Applied Digital, a builder and operator of next-generation data centers, has launched an infrastructure partnership with ABB at the company's greenfield 400 MW campus in North Dakota, United States. The collaboration will innovate fast, reliable, energy-efficient solutions to meet the needs of rapidly advancing artificial intelligence (AI) capabilities. As part of this long-term partnership, the first orders were booked in Q4 2024 and Q1 2025. Further financial details of the partnership were not disclosed.

I recommend ABB Ltd as a Buy with a $64.39 price target, driven by strong market opportunities in automation, electrification, and data centers. ABB's planned divestiture of its robotics unit could boost margins and free capital for additional M&A or ABBNY shareholder returns, enhancing overall value. ABB's local production and pricing actions may help mitigate direct tariff risks but may face indirect risks from slower backlog conversion.

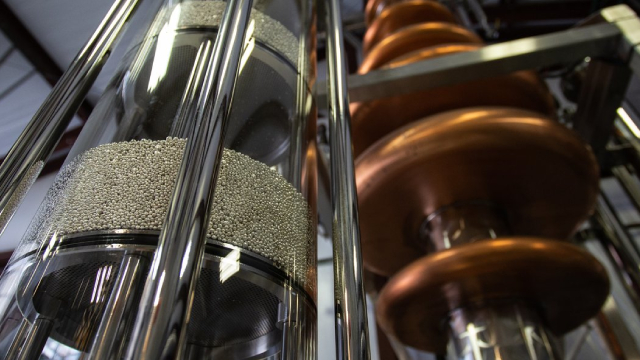

ABB ( ABBNY ) is a $100 billion Zurich-based industrial company that specializes in electrification and automation. ABB's products and services help manufacturers and governments achieve greater efficiency, energy management, and sustainability.

In 2024, the homes and buildings industry saw a 6.9% growth, thriving amid uncertainties. Projections for 2025 range from 4.3% to 8.6%, fueled by AI, IoT, and smart solutions. Despite challenges like rising O&M costs and labor shortages, innovations in AI and automation are reshaping the industry. In 2024, the homes and buildings industry saw a 6.9% growth, thriving amid uncertainties. Projections for 2025 range from 4.3% to 8.6%, fueled by AI, IoT, and smart solutions. Despite challenges like rising O&M costs and labor shortages, innovations in AI and automation are reshaping the industry.

Automation company ABB is reportedly preparing a possible deal for its robotics unit. The company is working with Bank of America and UBS on a spinoff or sale of the robotics business, Bloomberg News reported Tuesday (May 27), citing sources familiar with the matter.

Here is how ABB (ABBNY) and Stratasys (SSYS) have performed compared to their sector so far this year.

While the top- and bottom-line numbers for ABB (ABBNY) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.