AEE Stock Recent News

AEE LATEST HEADLINES

Does Ameren (AEE) have what it takes to be a top stock pick for momentum investors? Let's find out.

ST. LOUIS , Feb. 27, 2025 /PRNewswire/ -- Ameren Corporation (NYSE: AEE) announced today the pricing of a public offering of $750 million aggregate principal amount of 5.375% senior notes due 2035 at 99.822% of their principal amount. The transaction is expected to close on March 7, 2025, subject to the satisfaction of customary closing conditions.

ST. LOUIS , Feb. 24, 2025 /PRNewswire/ -- Ameren Illinois Company, a subsidiary of Ameren Corporation (NYSE: AEE), announced today the pricing of a public offering of $350 million aggregate principal amount of 5.625% first mortgage bonds due 2055 at 99.986% of their principal amount. The transaction is expected to close on March 3, 2025, subject to the satisfaction of customary closing conditions.

Here is how Ameren (AEE) and CenterPoint Energy (CNP) have performed compared to their sector so far this year.

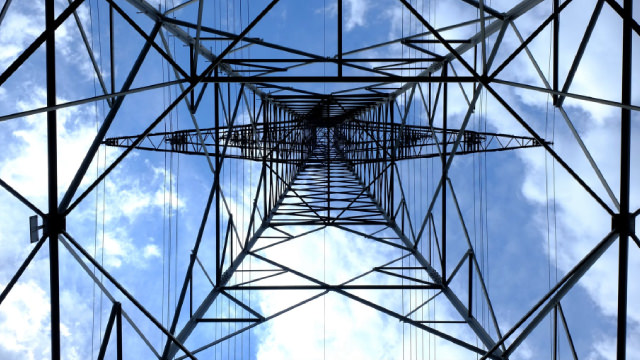

Despite near-term weakness in the electric power industry, utilities like VST, EXC, ETR and AEE are set to benefit from their systematic investments, which allow them to serve their customers efficiently.

Ameren Corporation (NYSE:AEE ) Q4 2024 Earnings Conference Call February 14, 2025 10:00 AM ET Company Participants Andrew Kirk - Senior Director, Investor Relations and Corporate Modeling Martin Lyons - Chairman, President and Chief Executive Officer Michael Moehn - Senior Executive Vice President and Chief Financial Officer Conference Call Participants Shahriar Pourreza - Guggenheim Securities Durgesh Chopra - Evercore ISI Nicholas Campanella - Barclays Carly Davenport - Goldman Sachs Julien Dumoulin-Smith - Jefferies Anthony Crowdell - Mizuho Securities William Appicelli - UBS Jeremy Tonet - JPMorgan David Paz - Wolfe Research Operator Greetings and welcome to Ameren Corporation Fourth Quarter 2024 Earnings Conference Call. At this time, all participants are in a listen-only mode.

AEE's Q4 total operating revenues of $1.94 billion rise 20% year over year and beat the Zacks Consensus Estimate by 10.3%.

U.S. energy firm Ameren's Missouri unit said on Friday that it had made significant changes to its strategy to accelerate investment in generation, bolster reliability and create jobs.

Company also details benefits from Smart Energy Plan investments in a stronger grid that saved customers 8 million minutes in outages in 2024 ST. LOUIS , Feb. 14, 2025 /PRNewswire/ -- Ameren Missouri, a subsidiary of Ameren Corporation (NYSE: AEE), announced a significant change to its generation strategy, aiming to accelerate generation investments to support robust economic expansion, bolster reliability and create jobs across Missouri.

The headline numbers for Ameren (AEE) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.