AEM Stock Recent News

AEM LATEST HEADLINES

Agnico (AEM) could produce exceptional returns because of its solid growth attributes.

Here is how Agnico Eagle Mines (AEM) and Franco-Nevada (FNV) have performed compared to their sector so far this year.

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

In the closing of the recent trading day, Agnico Eagle Mines (AEM) stood at $127.2, denoting a -1.1% move from the preceding trading day.

Agnico (AEM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Agnico (AEM) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

AEM is fueling shareholder returns with robust free cash flow and may boost buybacks amid firm gold prices.

An investment must pass two key tests to qualify as a high conviction pick for me. I share my two highest conviction investments right now. I detail why they are my highest conviction investments.

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

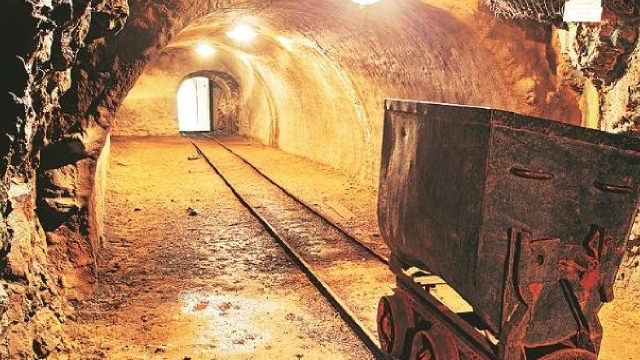

Gold is booming, but the real story isn't macro. It's a supply crisis. Flat output, falling ore grades, and soaring costs are the real game-changers. Despite record margins, miners aren't boosting output. Labor issues, energy costs, and geopolitics are crushing growth, even as prices surge. I'm doubling down on low-cost miners in safe regions and looking beyond mining for high-margin royalty plays. Gold's uptrend may just be starting.