AME Stock Recent News

AME LATEST HEADLINES

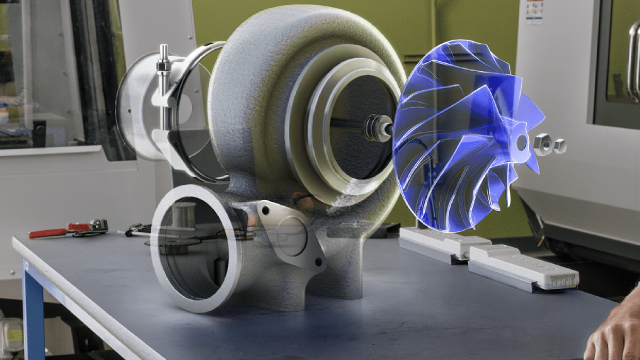

LAKE MARY, Fla., July 21, 2025 (GLOBE NEWSWIRE) -- AMETEK, Inc. today announced that it has completed its acquisition of FARO Technologies, a global leader in 3D measurement and imaging solutions. FARO will join Creaform and Virtek as part of AMETEK's Ultra Precision Technologies Division.

BERWYN, Pa. , July 21, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced that it has completed its acquisition of FARO Technologies, Inc. for $44.00 per share in cash, or approximately $920 million, net of cash acquired.

- Earnings to be released before market opens on Thursday, July 31, 2025 - BERWYN, Pa. , July 15, 2025 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) will issue its second quarter 2025 earnings release before the market opens on Thursday, July 31, 2025.

NEW YORK & NEW ORLEANS--(BUSINESS WIRE)--Former Attorney General of Louisiana Charles C. Foti, Jr., Esq. and the law firm of Kahn Swick & Foti, LLC (“KSF”) are investigating the proposed sale of FARO Technologies, Inc. (NasdaqGS: FARO) to AMETEK, Inc. (NYSE: AME). Under the terms of the proposed transaction, shareholders of FARO will receive $44.00 in cash for each share of FARO that they own. KSF is seeking to determine whether this consideration and the process that led to it are adequate.

The Zacks Electronics -Testing Equipment industry players, such as AME, ITRI and CGNX, are poised to benefit from the solid demand for testing instruments.

Review Ametek's (AME) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

NEW YORK & NEW ORLEANS--(BUSINESS WIRE)--Former Attorney General of Louisiana Charles C. Foti, Jr., Esq. and the law firm of Kahn Swick & Foti, LLC (“KSF”) are investigating the proposed sale of FARO Technologies, Inc. (NasdaqGS: FARO) to AMETEK, Inc. (NYSE: AME). Under the terms of the proposed transaction, shareholders of FARO will receive $44.00 in cash for each share of FARO that they own. KSF is seeking to determine whether this consideration and the process that led to it are adequate.

BERWYN, Pa. , May 8, 2025 /PRNewswire/ -- The Board of Directors of AMETEK, Inc. (NYSE: AME) declared a regular quarterly dividend of $0.31 per share for the second quarter ending June 30, 2025.

AMETEK offers solid downside protection due to strong pricing power in niche markets and limited exposure to China, with a 12.42% return potential in 6–9 months. The company's diversified business model and historical resilience in inflation and tariff periods ensure margin expansion and revenue growth, even in economic downturns. A low leverage ratio and history of strategic acquisitions suggest potential for a significant M&A deal, enhancing growth prospects and financial flexibility.

Industrial tools maker AMETEK will acquire FARO Technologies at an enterprise value of about $920 million, the two companies said on Tuesday, sending the target firm's shares soaring 36% in early trade.