AMGN Stock Recent News

AMGN LATEST HEADLINES

Amgen aims to challenge obesity drug leaders with MariTide, a potential monthly treatment now in late-stage trials.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

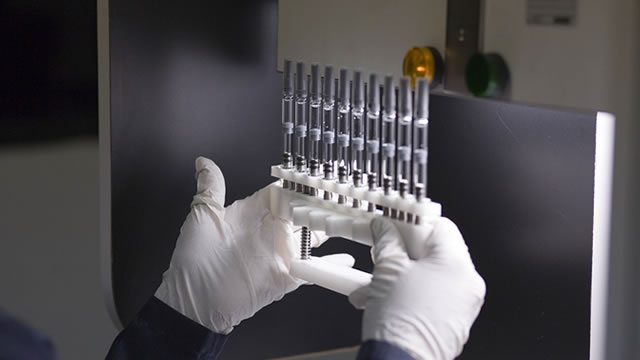

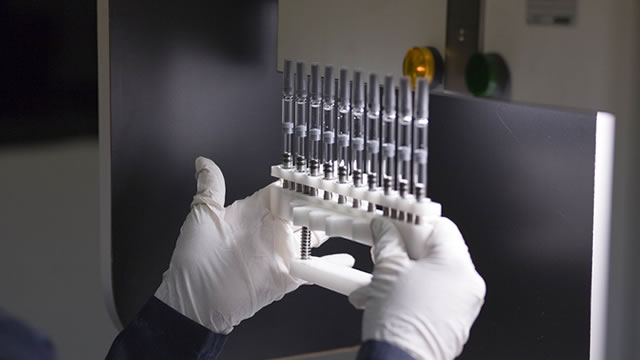

Amgen Inc AMGN announced on Monday the full results from Part 1 of the Phase 2 study of MariTide (maridebart cafraglutide, formerly AMG 133), a long-acting, peptide-antibody conjugate subcutaneously administered monthly or less frequently.

Amgen stock (NASDAQ:AMGN) fell 6% on Monday, June 23, 2025, after mid-stage clinical trial results for its long-acting experimental obesity drug, MariTide, revealed a need for a low starting dose to mitigate side effects like vomiting. Amgen plans to proceed with Phase 3 trials, initiating patients on a lower dosage that will gradually increase with an eight-week dose escalation period.

Amgen Inc. (NASDAQ:AMGN ) Special Call (IR Call) Conference June 23, 2025 5:30 PM ET Company Participants Justin Claeys - Vice President of Investor Relations James Bradner - Executive Vice President of Research & Development Susan Sweeney - Executive Vice President of Obesity & Related Conditions Murdo Gordon - Executive Vice President of Global Commercial Operations Conference Call Participants Salveen Richter - Goldman Sachs Group, Inc., Research Division Michael Yee - Jefferies LLC, Research Division Yaron Werber - TD Cowen, Research Division Terence Flynn - Morgan Stanley, Research Division Trung Huynh - UBS Investment Bank, Research Division Evan Seigerman - BMO Capital Markets Equity Research David Amsellem - Piper Sandler & Co., Research Division David Risinger - Leerink Partners LLC, Research Division Umer Raffat - Evercore ISI Institutional Equities, Research Division Taylor Hanley - JPMorgan Chase & Co, Research Division Matthew Phipps - William Blair & Company L.L.C., Resea

In the latest trading session, Amgen (AMGN) closed at $272.44, marking a -5.84% move from the previous day.

Jared Holxz, Mizuho, joins 'Fast Money' to talk competition in the obesity drug space.

At the highest dosage of MariTide, 27% of patients stopped the drug due to a gastrointestinal adverse event.

People started on a low dose of Amgen's long-acting experimental obesity drug MariTide lost as much weight as those given high doses but with milder side effects, according to full results of a mid-stage trial presented at a medical meeting on Monday.