AOS Stock Recent News

AOS LATEST HEADLINES

MILWAUKEE , April 7, 2025 /PRNewswire/ -- Directors of A. O. Smith Corporation (NYSE: AOS) today declared a regular quarterly cash dividend of $.34 per share on the company's Common Stock and Class A Common Stock.

There's significant turmoil in the industrial sector right now. Companies are navigating a foggy horizon rife with actual and potential tariffs, and the economy is more uncertain than it has been since the height of the coronavirus pandemic.

MILWAUKEE , April 2, 2025 /PRNewswire/ -- A. O. Smith Corporation (NYSE: AOS) will release its first quarter 2025 financial results before the market opens on Tuesday, April 29, and has scheduled an investor conference call to follow at 10:00 a.m.

Softness in the Rest of the World segment, supply-chain constraints and unfavorable foreign-currency movement are weighing on AOS' performance.

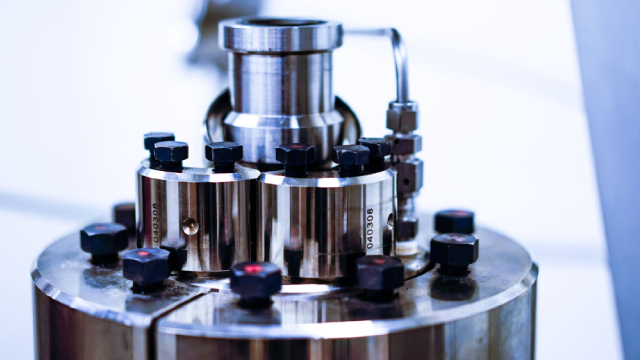

Company recognized for its commitment to robust ethics, compliance and governance programs MILWAUKEE , March 11, 2025 /PRNewswire/ -- A. O. Smith Corporation (NYSE: AOS), a leader in water heating and water treatment, announces today it has been recognized as a 2025 World's Most Ethical Company by Ethisphere, a global leader in defining and advancing the standards of ethical business practices.

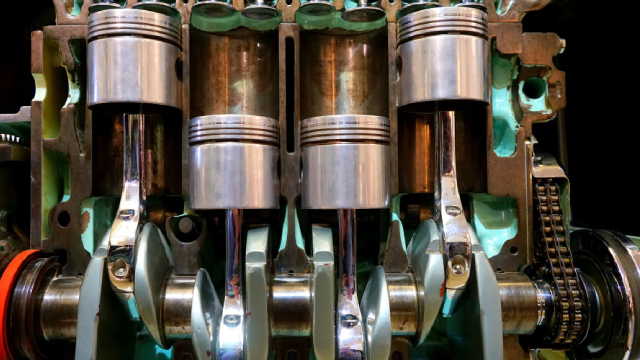

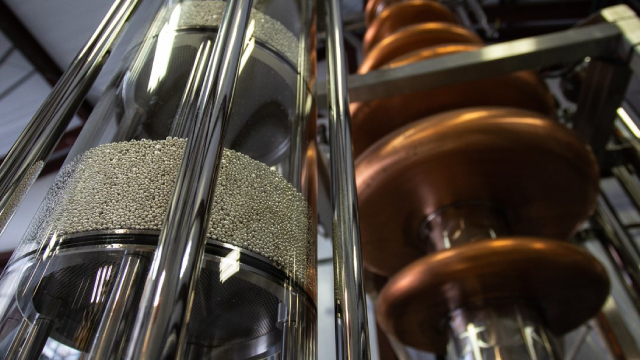

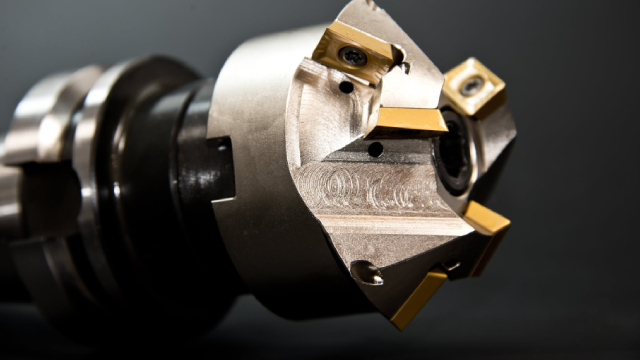

A. O. Smith Corp., manufacturer of a broad range of residential and commercial water heaters and boilers, along with water and air purification systems, is now an $8 billion (by market cap) water technology leader. To date, AOS increased its dividend for 31 consecutive years, with a 10-year dividend growth rate of 15.8%. A. O. Smith moved its revenue from $2.5 billion in FY 2015 to $3.8 billion in FY 2024, a compound annual growth rate of 4.8%.

S&P Dow Jones Indices added three new members to the S&P 500 Dividend Aristocrats Index, expanding it to 69 companies. I rank Dividend Aristocrats by quality scores, presenting undervalued and overvalued stocks with detailed metrics and fair value estimates. My quality scoring system uses six indicators, each worth 5 points, for a maximum score of 30, categorizing stocks from Exceptional to Inferior.

ASGN, AOS and EADSY have been added to the Zacks Rank #5 (Strong Sell) List on February 24, 2025.

A.O. Smith holds the potential to reap the benefits of accretive acquisitions. However, weakness in the Chinese real estate market is concerning.

#Morningstar #TopDividendStocks #DividendInvesting Two names this month are dividend aristocrats. 00:00 Introduction 00:10 A.O.