ASML Stock Recent News

ASML LATEST HEADLINES

ASML remains a compelling buy, with robust earnings growth, dominant market position, and strong AI-driven demand supporting the investment thesis. Recent results show sales up 31% and EPS surging to $6.86, with expanding margins and a fortress balance sheet fueling future innovation. Valuation is attractive: current multiples are well below historical averages, offering rare upside for a high-quality, industry-leading company.

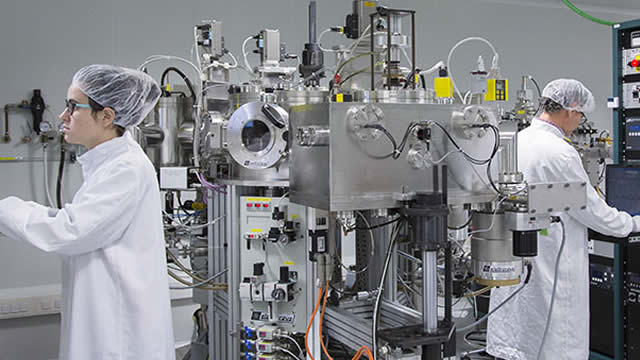

Few companies' products are as critical to the modern world's technological infrastructure as those made by ASML (ASML 3.75%). Without the chipmaking equipment the Netherlands-based manufacturer provides, much of the world's most innovative technology wouldn't be possible.

UBS just upgraded Netherlands-based semiconductor equipment stock ASML Holding NV (NASDAQ:ASML) to "buy," with a price-target hike to €750 from €660, citing potential upside after the stock's recent underperformance.

Docusign (DOCU) moved higher after posting and earnings beat and doubling down on A.I. advancements.

ASML Holding NV (NASDAQ:ASML, ETR:ASME) has been upgraded to 'buy' by UBS, which sees the semiconductor equipment maker as poised to return to form as a “quality compounder” from 2027 onwards. The bank highlighted that the market has already priced in concerns over weakening lithography intensity and uncertainty in China, with the shares down 30% from all-time highs in the summer of 2024.

Among the largest stocks in Europe, ASML has underperformed its benchmark Euro Stoxx 50 index by around 15% in 2025 so far. That's far enough for UBS which has upgraded the stock to buy on Friday, while bumping up its target price from €660 to €750.

In the latest trading session, ASML (ASML) closed at $725.85, marking a -2.26% move from the previous day.

The artificial intelligence (AI) boom has been fueled by large tech companies developing impressive AI models that can handle increasingly complex tasks. But a sometimes overlooked aspect of AI are the companies that manufacture complex processors that make those models possible.

ASML Holding N.V.'s recent share price weakness is a buying opportunity for long-term investors, given its strong fundamentals and leading position in EUV technology. The company posted robust financial results, with 23% revenue growth and improving margins, driven by surging demand for EUV machines in AI and memory applications. Despite management's cautious 2026 outlook due to tariff and geopolitical risks, I believe these concerns are overblown and cyclical volatility is natural.

Since the launch of ChatGPT in 2022, artificial intelligence (AI) has been the driving force in the tech market. Most of the major tech companies are incorporating AI into their products, and the AI market is projected to grow to $4.8 trillion annually by 2033, according to a United Nations Trade and Development report.