ASML Stock Recent News

ASML LATEST HEADLINES

Stocks have taken a dip, and some have been falling far more than they should. Some of these stocks look like great buys, and I am adding them to my portfolio.

Key Points in This Article: The $1.7 trillion U.S.

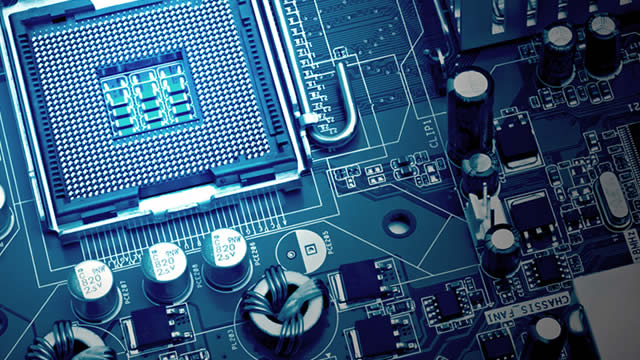

There are a few players in the technology sector who have a near monopoly in their businesses, and investors can use that to their advantage when planning for the next outsized upside play in their portfolios. Knowing what to look for comes into play for the savvy ones, and those who can connect the dots will likely land on the right side of history in this artificial intelligence gold rush.

The stock market remains on an upward trajectory, and the major market indexes are at all-time highs as investors continue piling into the leading technology companies. What's the cause?

Just when you start to see hints indicating the boom of artificial intelligence (AI) stocks is coming to an end, signs that the boom will continue emerge. That has helped AI stocks continue to rocket higher and higher.

Live Updates Live Coverage Has Ended Stock Will Be Very Down Tomorrow 5:24 pm Well, nothing was said on the Applied Materials call to change around steep after hours losses. The company is down 14% as of 5:25 p.m. ET. Will this be the start of long-term troubles or a buying opportunity? It’s our opinion that over a long-term time frame a company like Applied Materials remains a compelling investment opportunity. With that being said, the coming quarters are very challenging for companies as the Trump Administration has made limiting semiconductor equipment a primary focus during trade negotiations. Here's Applied Materials' Defense of Thier Long-Term Trajectory 4:59 pm Here’ s what AMAT CEO Gary Dickerson had to say about the company’s guidance and defense of their long term opportunity: “For Applied’s business, there are 3 main factors that mute our outlook for the quarter ahead. First is digestion of capacity in China. Second is our large backl

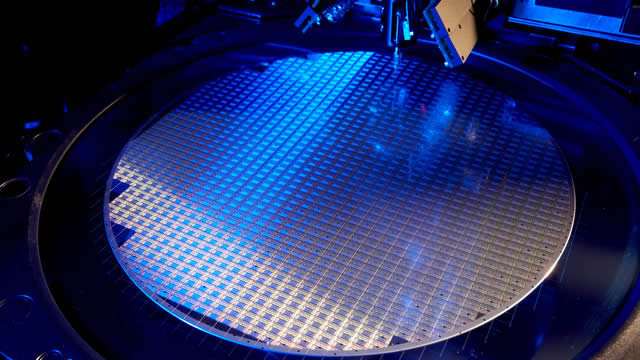

ASML Holding targets 30% EUV revenue growth in 2025, fueled by Low NA expansion, High NA shipments, and AI-driven chip demand.

It's been an excellent summer for the broader stock market, with the major indexes hovering around all-time highs and strong earnings from many top companies.

ASML (ASML -1.92%) informed investors that it may not experience revenue growth in 2026.

ASML delivered strong Q2 results last week, beating EPS and revenue estimates due to surging AI-driven demand for its lithography systems. The company's unique and irreplaceable position in the semiconductor value chain as well as robust moat support its premium valuation. ASML maintained strong gross margins in Q2 and saw a solid free cash flow recovery as well.