AVA Stock Recent News

AVA LATEST HEADLINES

SPOKANE, Wash., July 08, 2025 (GLOBE NEWSWIRE) -- Avista Corp. (NYSE: AVA) will hold its quarterly conference call and webcast to discuss second quarter 2025 results on Wednesday, Aug. 6, 2025, at 10:30 a.m. Eastern Daylight Time. A news release with second quarter 2025 earnings information will be issued at 7:05 a.m. Eastern Daylight Time on Aug. 6, 2025.

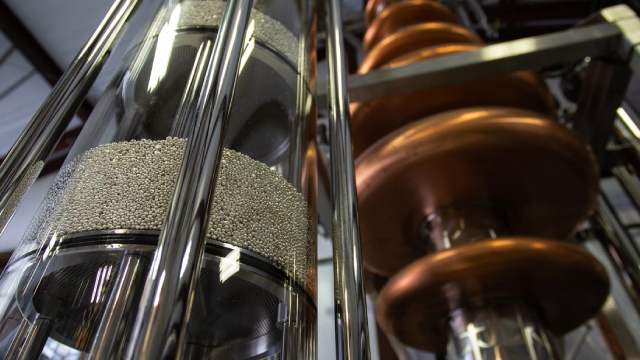

Goldman Sachs Alternatives served as lead investor; additional investments from BlackRock Secondaries & Liquidity Solutions NEW YORK , June 24, 2025 /PRNewswire/ -- Avista Healthcare Partners ("Avista"), a leading private equity firm focused exclusively on healthcare, today announced the successful close of Avista Healthcare Partners CV II, L.P., a single-asset continuation fund for GCM, a leading outsourced manufacturer of complex precision components for high-growth medical technology end markets.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Pinnacle West and Avista represent a classic investing tradeoff: faster growth with greater risks and a richer valuation vs. slower growth with a lower ceiling at a discounted price. Pinnacle West offers higher long-term growth potential driven by Arizona's electrification, but risks include its heavier capex, regulatory uncertainty, and increased leverage. Avista has provided steadier returns, a higher dividend yield, and a more conservative balance sheet, but has limited long-term growth catalysts.

If approved, new rates would take effect beginning Sept. 2025 and Sept. 2026 If approved, new rates would take effect beginning Sept. 2025 and Sept. 2026

I have a 'Buy' rating for Avista under $38, with a fair value estimate of $42.12, offering ~10% upside. Avista's regulated utility business, stable dividend yield, and modest growth support my investment thesis, despite lower ROE versus peers. My options strategy—selling puts and put spreads—offers leveraged returns, while I remain cautious due to illiquid options.

Fire Safety mode increases power line sensitivity ahead of the 2025 wildfire season. Fire Safety mode increases power line sensitivity ahead of the 2025 wildfire season.

SPOKANE, Wash., May 30, 2025 (GLOBE NEWSWIRE) -- Avista, through a request for proposal (RFP), is seeking proposals from bidders to add energy and capacity including distributed energy resources, to meet projected resource needs.

Dividend yields are rising on these 10 stocks. Dividend yields tend to on one of two occasions: the company is raising the dividend payout or the share price is sinking.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.