AVAV Stock Recent News

AVAV LATEST HEADLINES

AeroVironment NASDAQ: AVAV investors have been on a stomach-churning rollercoaster. The unmanned systems leader saw its stock price surge to a new 52-week high, reaching nearly $295 per share, after releasing a blockbuster earnings report on June 24, 2025.

Live Updates Live Coverage Has Ended Senate Greenlights Trump Spending Bill 1:16 pm by Gerelyn Terzo The U.S. Senate has passed President Trump’s Big Beautiful bill, including tax cuts and reduced Medicaid spending. After a tie-breaking vote by Vice President Vance, the bill – the very one that has caused a rift between President Trump and Elon Musk – is now set to be debated by the House of Representatives with a July 4 deadline in sight. The bill is set to add a reported $3.3 trillion in debt to America’s balance sheet. The markets remain aimless, with the Nasdaq Composite now lower by 0.55%. Ford's Upside Surprise 11:41 am by Gerelyn Terzo Automaker Ford (NYSE: F) revealed that its Q2 sales increased by 14%, blowing past the consensus estimates of a 1.4% gain. Driving the results were sales of both fossil fuel and EVs, including its F-Series trucks as well as hybrid and EVs, which are part of its electrified vehicle segment. Consumers also prioritized ve

AeroVironment Inc (NASDAQ: AVAV) opened more than 7.0% down this morning after revealing plans to raise about $1.35 billion in fresh capital. The defense contractor will raise $750 million through a common stock offering with the balance coming from convertible senior notes expiring in 2030, according to its press release on Tuesday.

AeroVironment shares fell after the defense contractor said it plans to offer $750 million in common stock and $600 million in convertible senior notes. The drone maker said it would use the funding to pay off debt and use leftover proceeds for general purposes such as boosting manufacturing capacity.

The U.S. defense industry is unmatched, backed by nearly $1 trillion in annual spending, supporting my long-standing investment in dividend-paying giants. A new wave of disruptors is shaking things up, blending AI and autonomy to chase growth, but sky-high valuations demand caution and realism. I prefer reliable incumbents, but I'm closely tracking promising innovators, because in this evolving battlefield, both camps may win big.

Live Updates Live Coverage Has Ended So Close and Yet so Far 4:09 pm by Gerelyn Terzo The S&P 500 and Nasdaq Composite indices both crossed over into record territory during today’s trading session but they came off those lofty levels by the market closing. The Nasdaq Composite still closed up about 1% to 20,167.91 while the S&P 500 index finished the day 0.80% higher at 6,141.02. Big Tech Downgrade 12:55 pm by Gerelyn Terzo While Tesla stock received a ringing endorsement from Wall Street analysts today, Apple (Nasdaq: AAPL) is seeing the other side of the spectrum. JPMorgan analysts lowered their price target on the iPhone maker to $230 from $240, keeping their “overweight” rating on the stock. The analysts are worried about demand for the iPhone 17. Apple shares are lower by 0.79% today. The Nasdaq Composite is now up 0.70%. Benchmark Bullish on TSLA 11:01 am by Gerelyn Terzo Wall Street research firm Benchmark is bullish on EV leader Tesla (Nasdaq: TSLA).

BLIN, AVAV and COLD have been added to the Zacks Rank #5 (Strong Sell) List on June 27, 2025.

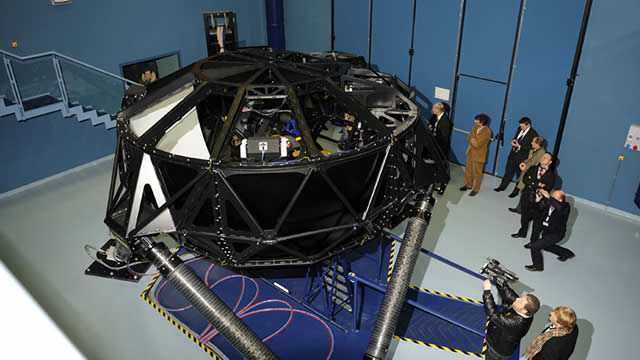

Aerovironment (AVAV) soared after the FAA Acting Commissioner said the agency is working to safely integrate drones it and its peers create. As George Tsilis adds, geopolitical tensions and strong earnings backed the stock's rally.

After dipping almost 3% lower last week, shares of AeroVironment (AVAV 15.86%) have steadily gained more altitude this week for a variety of reasons. For one, the market is responding kindly to the drone company's fourth-quarter 2025 financial results, which it released on Tuesday.

AeroVironment (NASDAQ:AVAV), a prominent drone manufacturer, experienced a stock surge of over 20% on June 25th following the release of stronger-than-anticipated Q4 results (the fiscal year concludes in April). The company's adjusted earnings of $1.61 per share and sales of $275 million significantly exceeded the consensus forecasts of $1.39 and $242 million, respectively.