AVGO Stock Recent News

AVGO LATEST HEADLINES

The latest trading day saw Broadcom Inc. (AVGO) settling at $288.21, representing a +1.72% change from its previous close.

Broadcom AVGO and Okta OKTA are key providers of security software solutions for enterprises. AVGO offers Endpoint Security (Symantec and Carbon Black), Network Security, Information Security, Application Security (Carbon Black) and Identity Security solutions.

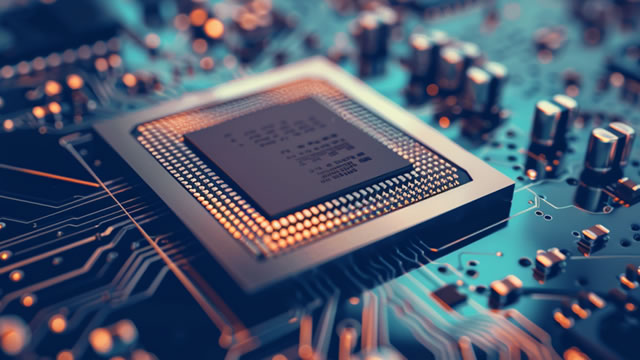

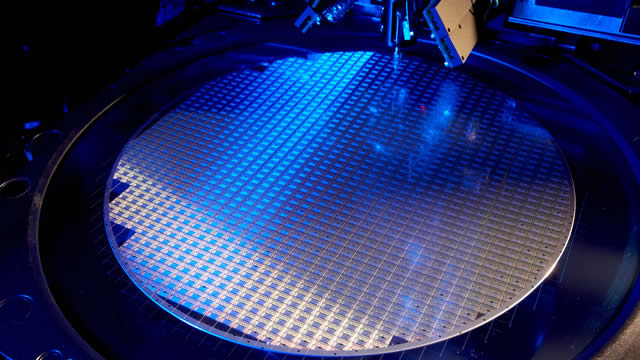

The Investment Committee discuss their top picks in the semiconductor sector.

Growth stocks continue to drive the market higher, led by companies in the technology sector. With the market heating up, now is still a great time to add some growth names to your portfolio.

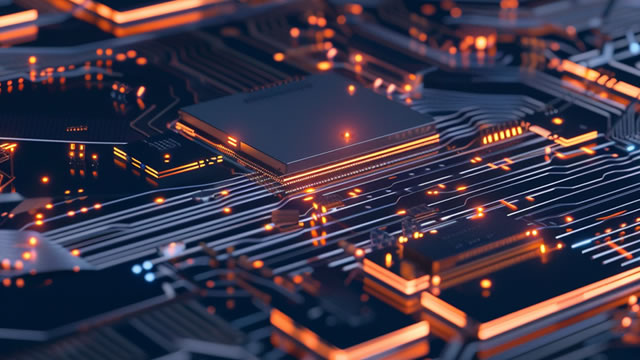

Since late 2022, the evolution of artificial intelligence (AI) has been Wall Street's hottest trend. The ability for software and systems empowered by AI to make split-second decisions without the aid of humans is a game-changing technology that the analysts at PwC estimate can add $15.7 trillion to the global economy come 2030.

Stock splits were a big thing last year, with many major companies across industries launching such operations. Two of the most exciting were in the area of artificial intelligence (AI).

It will be a massive undertaking to build out the hardware and support necessary to power increasingly advanced artificial intelligence and provide it at a global level where billions of people can access it.

The AI room really has some strong legs as we march through the peak of the summer season.

David Tepper is one of the most successful investment managers on Wall Street. His Appaloosa Management hedge fund has produced gross annualized returns of more than 28% since its inception in 1993.

Investing in top growth stocks is a great way to achieve strong returns and potentially outperform the market as a whole. The S&P 500 is an index of the leading companies on the U.S. markets, and historically, it has risen by 10% per year, though that's an average including up and down years.