BAX Stock Recent News

BAX LATEST HEADLINES

At the 2025 HIMSS Global Healthcare Conference, BAX unveils its Voalte Linq device, powered by Scotty assistant, a voice-activated technology.

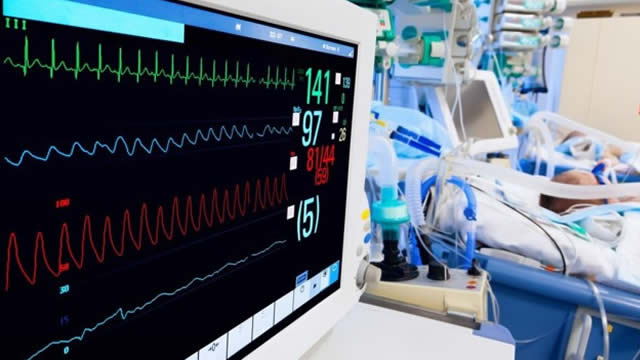

LAS VEGAS--(BUSINESS WIRE)--Baxter International Inc. (NYSE:BAX), a global medtech leader, today unveiled Voalte Linq device powered by Scotty assistant, the company's first voice-activated technology, at the 2025 HIMSS Global Healthcare Conference. Voalte Linq, a lightweight, wearable badge, is powered by Scotty assistant, a voice-activated technology, to better enable efficient, streamlined communication between care teams, with the goal of freeing up more of their time and energy to focus on.

Dublin, March 03, 2025 (GLOBE NEWSWIRE) -- The "Medical Penlight Market Size, Share & Trends Analysis Report By Type (Consumables, Equipment), By Light Output (Oncology, Cardiovascular Diseases), By Usability (Disposable, Reusable), By End-use, By Region, And Segment Forecasts, 2025 - 2030" report has been added to ResearchAndMarkets.com's offering. The global medical penlight market size was estimated at USD 279.7 million in 2024 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. The market is driven significantly by the product's utility in diagnosing and assessing eye and ear conditions. According to a WHO report from August 2023, approximately 2.2 billion individuals experience distance vision impairment. Out of this group, vision impairment in at least 1 billion cases could have been prevented or remains untreated. Refractive errors and cataracts are identified as the primary causes of vision impairment and blindness worldwide. Medical professionals rely on penlights fo

Kontoor Brands Chair, President, and CEO Scott Baxter joins 'Mad Money' host Jim Cramer to talk acquiring Helly Hansen, international business, and more.

Baxter reports better-than-expected fourth-quarter results. However, the company's gross and operating margins contract.

Baxter International Inc. (BAX) Q4 2024 Earnings Conference Call Transcript

On Thursday, Baxter International Inc. BAX reported a fourth-quarter 2024 adjusted EPS of 58 cents, beating the management guidance of 50 cents-53 cents and the Wall Street estimate of 52 cents.

The headline numbers for Baxter (BAX) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Baxter International on Thursday forecast 2025 profit above Wall Street estimates banking on strong sales of its medical devices, sending the company's shares up 7% in premarket trade.

DEERFIELD, Ill.--(BUSINESS WIRE)--Baxter International Inc. (NYSE:BAX), a global medtech leader, will present at the TD Cowen 45th Annual Health Care Conference on Wednesday, March 5, 2025. Joel Grade, Baxter's chief financial officer, is scheduled to present at 1:10 p.m. Eastern Time. The live webcast of Baxter's presentation can be accessed at www.baxter.com and will be available for replay through Monday, September 1, 2025. About Baxter Every day, millions of patients, caregivers and healthc.