BTU Stock Recent News

BTU LATEST HEADLINES

Peabody Energy said on Tuesday it has withdrawn its $3.78 billion bid for Anglo American's Australian coking coal assets, after failing to renegotiate a lower price for the deal following a production halt caused by a fire.

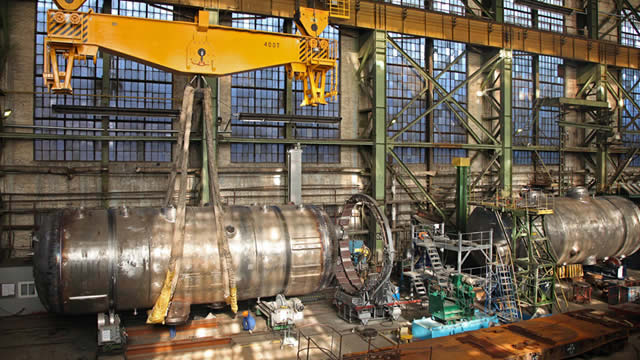

ST. LOUIS , Aug. 19, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that it has terminated purchase agreements with Anglo American Plc due to a material adverse change (MAC, as defined under the purchase agreements) relating to Anglo's steelmaking coal assets. Peabody's decision to terminate the transaction comes nearly five months after an ignition event occurred at Anglo's Moranbah North Mine.

Peabody Energy Corporation (NYSE:BTU ) Q2 2025 Earnings Conference Call July 31, 2025 11:00 AM ET Company Participants James C. Grech - President, CEO & Director Malcolm Roberts - Chief Marketing Officer Mark A.

Peabody Energy Corporation's Q2 2025 results were weak, with significant margin declines and a miss on earnings, but some cost and sales guidance improved. The Anglo American coal asset deal remains uncertain due to operational issues, but renegotiation or cancellation is likely and would benefit Peabody's balance sheet. Centurion Mine is progressing ahead of schedule and will enhance Peabody's production and margins once operational, supporting future EBITDA growth.

Peabody Energy (BTU) came out with a quarterly loss of $0.06 per share versus the Zacks Consensus Estimate of a loss of $0.04. This compares to earnings of $1.43 per share a year ago.

Second Quarter Results Reflect Strong Seaborne and PRB Cost Performance Longwall Start at Centurion Mine Accelerated to February 2026 Favorable Changes to Full-Year Volume and Cost Targets ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) today reported net income attributable to common stockholders of $(27.6) million, or $(0.23) per diluted share, for the second quarter of 2025, compared to $199.4 million, or $1.42 per diluted share in the prior year quarter.

ST. LOUIS , July 31, 2025 /PRNewswire/ -- Peabody (NYSE: BTU) announced today that its Board of Directors has declared a quarterly dividend on its common stock of $0.075 per share, payable on September 3, 2025 to stockholders of record on August 14, 2025. Peabody is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel.

BTU is deeply undervalued, trading at 6x 2026 earnings and a 46% discount to book, with zero net debt and strong cash reserves. BTU remains highly profitable, generating over $1.5B in free cash flow in seaborne thermal lines and aggressively returning capital to shareholders via buybacks. Trump's return to office is a major tailwind, with regulatory rollbacks and friendlier coal policies extending the industry's runway.

Peabody Energy (BTU) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

As of July 18, 2025, two stocks in the energy sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.