CASY Stock Recent News

CASY LATEST HEADLINES

Food-forward convenience stores are stealing breakfast customers from fast-food chains. Morning meal traffic to fast-food chains rose 1% in the three months ended in July, while visits to food-forward convenience stores climbed 9% in the same period, according to Circana.

Here is how Casey's General Stores (CASY) and SharkNinja, Inc. (SN) have performed compared to their sector so far this year.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

CASY delivered strong Q1 results, with impressive inside store and fuel sales growth, validating its differentiated food strategy and operational efficiency. Despite robust fundamentals and market share gains, near-term headwinds from the CEFCO integration are weighing on margins, especially in Prepared Foods. Management's conservative guidance and slowing EBITDA growth outlook make the current valuation above 30x NTM PE look demanding.

Casey's (CASY) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

How Casey's General Stores is building an empire through small down dominance.

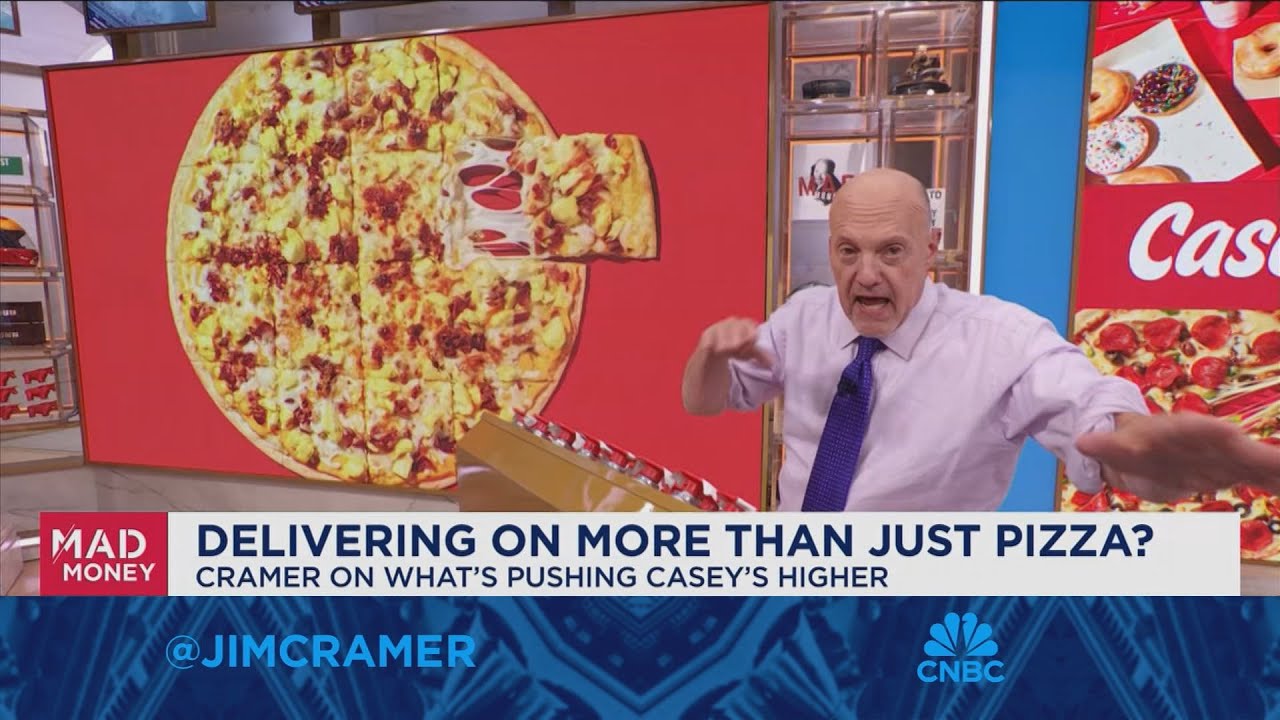

'Mad Money' host Jim Cramer fills up on the latest quarterly report out of Casey's General Store.

'Mad Money' host Jim Cramer fills up on the latest quarterly report out of Casey's General Store.

Casey's General Stores, Inc. (NASDAQ:CASY ) Q1 2026 Earnings Call September 9, 2025 8:30 AM EDT Company Participants Brian Johnson - Senior Vice President of Investor Relations & Business Development Darren Rebelez - President, CEO & Board Chair Stephen Bramlage - Senior VP & CFO Conference Call Participants Pooran Sharma - Stephens Inc., Research Division Charles Cerankosky - Northcoast Research Partners, LLC Charles Grom - Gordon Haskett Research Advisors Robert Griffin - Raymond James & Associates, Inc., Research Division Anthony Bonadio - Wells Fargo Securities, LLC, Research Division Michael Montani - Evercore ISI Institutional Equities, Research Division Bonnie Herzog - Goldman Sachs Group, Inc., Research Division Kelly Bania - BMO Capital Markets Equity Research Jacob Aiken-Phillips - Melius Research LLC Corey Tarlowe - Jefferies LLC, Research Division Presentation Operator Good day, and welcome to the First Quarter Fiscal Year 2026 Casey's General Stores Earnings Conference Cal

Investors win with Casey's General Stores NASDAQ: CASY in their portfolio because this must-own quality stock self-funds growth, grows profitably, generates cash flow, and returns capital to shareholders. The recipe is one of success, specifically in terms of steadily increasing shareholder value.