CCF Stock Recent News

CCF LATEST HEADLINES

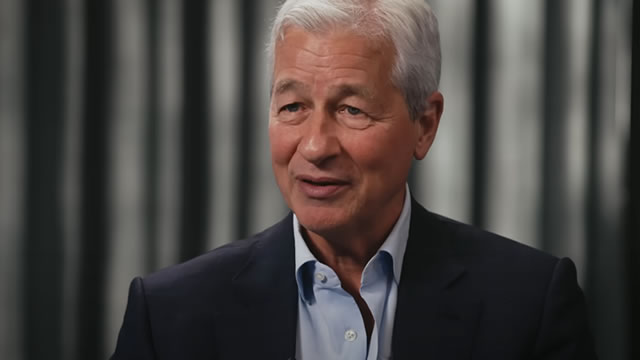

JPMorgan Chase CEO Jamie Dimon said his retirement is “several years away.” Asked about his plans by Marie Bartiromo during an appearance on Fox Business' Mornings With Maria that aired Monday (June 2), Dimon also said he may remain at the bank for a couple of years as chairman, executive chairman or a similar role.

JPMorgan's wealth management division is a key growth driver, with high returns and potential to unlock $12B+ in revenue by scaling First Republic's model. The bank's core business remains robust, with rising deposits, loan growth, conservative reserve management, and strong capital ratios supporting future earnings. Net interest income guidance is likely conservative; fewer rate cuts could provide a $2B+ earnings tailwind, further boosting results.

I monitor billionaires' investments in hedge funds, which gives me investment ideas and helps me determine whether my thoughts on a particular stock are still relevant.

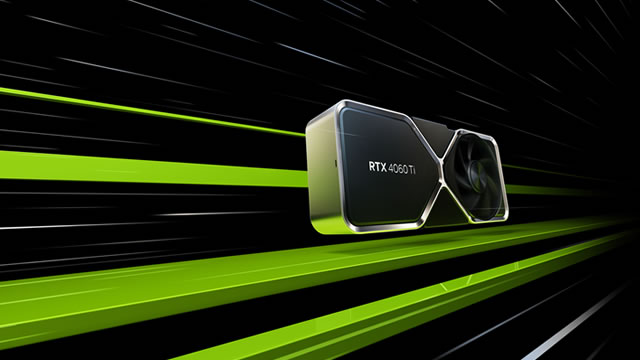

Despite reporting mixed Q1 results Wednesday evening, Nvidia (NVDA) stock has pooped as much as +6% in today's trading session and had retaken the top spot as the market's most valuable company.

For many investors, earnings season is the pinnacle of each quarter. It's a six-week period that provides an under-the-hood look at how well a majority of the most-influential public businesses driving the stock market higher or lower have performed.

It's that time of year again: Billionaire investors have offered us a peek into their latest investing moves through 13F filings. These are required quarterly by the Securities and Exchange Commission (SEC) from managers of more than $100 million in U.S. securities, and they detail the latest buys and sells of these major investors.

Jim Cramer breaks down why he's keeping an eye on shares of JPM.

For some investors, earnings season is the most-exciting period of each quarter. Over a span of six weeks, Wall Street's most-influential businesses lift their proverbial hoods and give investors an inside look at what's going on.

JPMorgan Chase & Co. reportedly launched a $500 million leveraged loan and plans to sell $2.3 billion in high-yield bonds to support Flutter Entertainment's purchase of Playtech's Italian gambling business called Snaitech. Flutter Entertainment, owner of FanDuel, tapped a bridge facility for the deal, which closed in late April, Bloomberg reported Monday (May 19).

Mike Mayo, managing director and head of US large-cap bank research at Wells Fargo Securities, says JPMorgan could be the first trillion dollar market cap bank. It's our Call of the Day.