CCL Stock Recent News

CCL LATEST HEADLINES

Carnival (CCL) closed at $31.51 in the latest trading session, marking a -2.96% move from the prior day.

Carnival (CCL) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Here is how Carnival (CCL) and Soho House & Co (SHCO) have performed compared to their sector so far this year.

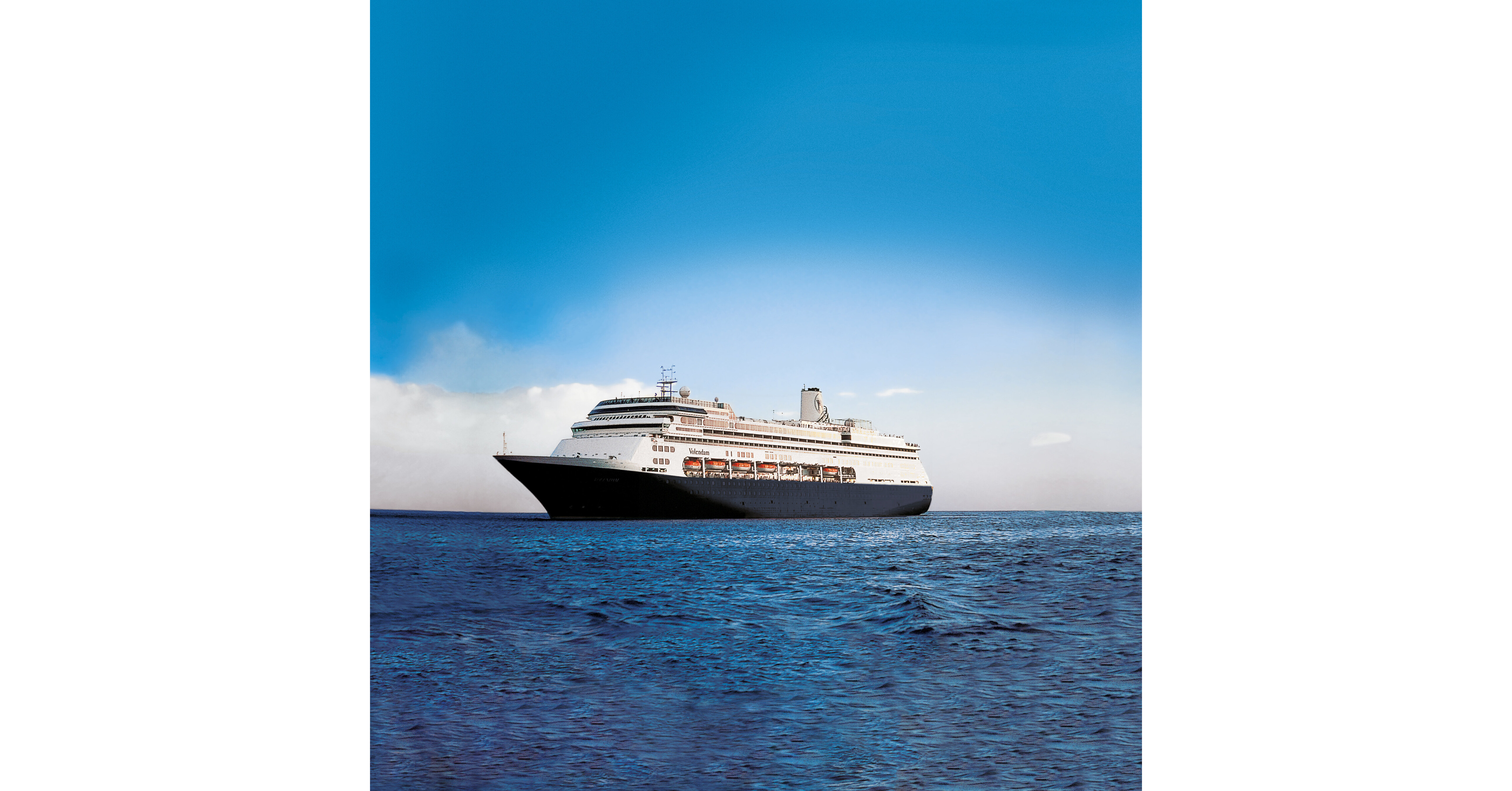

Carnival (CCL -0.65%) (CUK -0.94%) is the leading global cruise operator, and if you haven't been paying attention until recently, you might not realize that it was in serious danger just a few years ago. The pandemic-era climate made it impossible for it to make any money; it's literally the opposite of an essentials company.

Carnival (CCL -0.65%) was once sailing in very choppy waters. The company was facing a lot of uncertainty when the COVID-19 pandemic hit.

New lighthouse-themed voyage joins immersive itineraries that explore Canada & New England's scenic ports, historic landmarks and culinary traditions SEATTLE , Sept. 10, 2025 /PRNewswire/ -- Today, Holland America Line announced its 2027 Canada & New England season, featuring a collection of cruises designed to showcase the region's storied national parks and rich heritage — as well as a new itinerary dedicated to the area's iconic lighthouses.

'Fosse and Verdon, The Duet That Changed Broadway' will debut in November, featuring never-before-seen archival footage NEW YORK , Sept. 9, 2025 /PRNewswire/ -- Today, cruise line Holland America Line and RWS Global, the world's leader in live moments across entertainment and sports, announced the debut of "Fosse and Verdon, The Duet That Changed Broadway," an all-new live musical and multimedia tribute celebrating the revolutionary work of Bob Fosse and Gwen Verdon.

CCL boosts efficiency with $18M fuel savings in Q2, hitting record margins and advancing environmental targets.

Some passengers say cruise lines are nickel-and-diming them with all the surcharges.

Investors interested in Leisure and Recreation Services stocks are likely familiar with Carnival (CCL) and Atour Lifestyle Holdings Limited Sponsored ADR (ATAT). But which of these two stocks offers value investors a better bang for their buck right now?