CIO Stock Recent News

CIO LATEST HEADLINES

VANCOUVER , July 24, 2025 /PRNewswire/ -- City Office REIT, Inc. (NYSE: CIO) ("City Office", or the "Company") today announced that it has entered into a definitive merger agreement ("the Merger Agreement") with MCME Carell Holdings, LP and MCME Carell Holdings, LLC (collectively, "MCME Carell" or the "Buyer") under which, subject to the satisfaction of the conditions set forth in the Merger Agreement, MCME Carell will acquire (other than shares owned by the Buyer, the Company or their respective affiliates) all of the issued and outstanding shares of City Office for $7.00 per share of common stock in cash (the "Transaction"). Subject to the satisfaction of the conditions set forth in the Merger Agreement – which includes, among other things, the sale of the Company's Phoenix portfolio (as more thoroughly described in the Merger Agreement and accompanying filing made by the Company on Form 8-K) – holders of City Office's common stock will receive $7.00 per share in cash at closin

it's been nearly three months since gold climbed past $3,500 an ounce to its highest price on record, but five key factors to emerge since the start of President Donald Trump's second term are likely to support prices in the months ahead.

VANCOUVER , July 11, 2025 /PRNewswire/ -- City Office REIT, Inc. (NYSE: CIO) ("City Office" or the "Company") announced today it will release its financial results for the quarter ended June 30, 2025, before the market opens on Thursday, July 31, 2025. City Office's management will hold a conference call at 11:00 am Eastern Time on July 31, 2025 to discuss the Company's financial results.

Publicly listed US equity REITs ended June at a median 19.1% discount to their consensus NAV per share estimates, according to S&P Global Market Intelligence data. The hotel sector traded at the largest median discount to NAV at 35.5%, down from a 35.7% median discount to NAV as of May 30. Healthcare REITs continued to trade at the highest median premium, 19.3%, which is about 1.4 percentage points down from the 20.6% median premium to NAV as of May 30.

Investors looking for stocks in the REIT and Equity Trust - Other sector might want to consider either City Office REIT (CIO) or Omega Healthcare Investors (OHI). But which of these two companies is the best option for those looking for undervalued stocks?

CIO's asset base and leverage are reasonable, but weak liquidity and a challenging operating environment constrain its credit profile to a B3 rating. The preferred stock, CIO.PR.A, is rated Caa2, reflecting its higher risk and limited downside protection for investors. Despite attractive yields, the risk-reward profile for CIO's preferred stock is unfavorable due to low credit ratings and insufficient coverage of fixed costs.

US equity markets retreated from the cusp of record-highs this week as encouraging inflation data showing surprisingly muted tariff-related inflation was spoiled by a sudden escalation in Middle East tensions. The critical CPI and PPI reports both showed cooler-than-expected inflation in May for a third-straight month, as lower oil prices and moderating shelter costs more than offset the tariff uplift. Upsetting the key disinflationary offset that has kept overall inflation suppressed in recent months, the exchange of attacks between Iran and Israel sent global oil prices surging to four-month highs.

VANCOUVER , June 13, 2025 /PRNewswire/ -- City Office REIT, Inc. (NYSE: CIO) ("City Office," "CIO" or the "Company") announced today that its Board of Directors has authorized a quarterly dividend amount of $0.10 per share of common stock and common unit of partnership interest for the second quarter of 2025. Additionally, the Board of Directors authorized a regular quarterly dividend of $0.4140625 per share of the Company's 6.625% Series A Cumulative Redeemable Preferred Stock.

CHICAGO--(BUSINESS WIRE)--FourKites®, the global leader in AI-driven supply chain transformation, today announced that Josh Jewett, operating partner at NewRoad Capital Partners and former Chief Information Officer at Family Dollar and Dollar Tree, has joined its Strategic Advisory Council. Jewett brings extensive experience in retail technology strategy to FourKites' advisory council, where he will provide strategic guidance on product innovation and market expansion. During his eighteen-year.

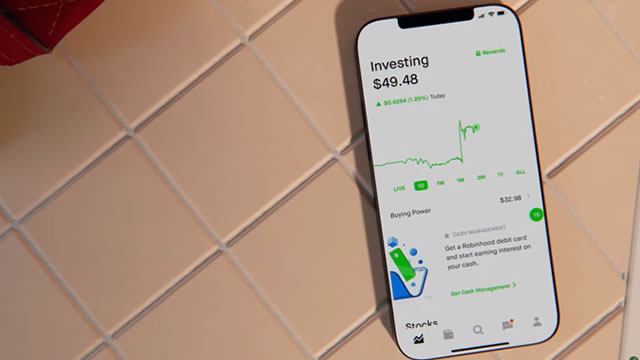

Stephnie Guild, Robinhood Financial CIO, joins 'Squawk Box' to discuss the latest market trends, state of the economy, navigating tariff uncertainty, S&P year-end target, and more.