CLS Stock Recent News

CLS LATEST HEADLINES

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Celestica (CLS) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Zacks.com users have recently been watching Celestica (CLS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Celestica's Q2 consensus remains conservative despite robust Q1 results, setting the stage for another potential earnings beat as AI-driven demand accelerates. The company's HPS networking products, now nearly 40% of revenue, continue to fuel higher-margin growth and support management's optimistic full-year guidance. Street estimates for Q2 EPS and revenue have barely budged, even as CLS's track record shows consistent outperformance and upward guidance revisions.

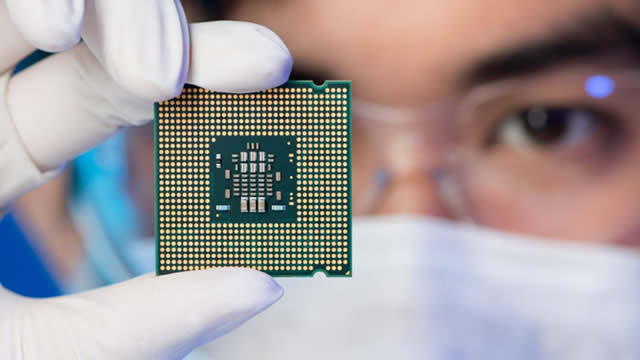

Celestica is a key enabler in the AI infrastructure buildout, assembling custom hardware for hyperscalers and benefiting from surging AI demand. Strong partnerships with major cloud customers and hyperscalers are driving significant market share gains and robust revenue growth in networking switches. Celestica's revenue and EPS growth far outpace sector medians, reflecting strong execution, margin expansion, and cost control in high-value AI infrastructure segments.

Celestica (CLS) reached $162.41 at the closing of the latest trading day, reflecting a +1.44% change compared to its last close.

As AI reshapes the EMS landscape, Jabil and Celestica take several initiatives to capitalize on the emerging market trend.

Celestica and Performance Food Group are at all-time highs. Both have scored a spot on IBD's screen for strong price action.

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Celestica's HPS sub-segment is driving structural margin expansion and higher profitability, supporting my continued bullish stance despite recent stock outperformance. Consensus Q2 estimates appear conservative given Celestica's strong track record of earnings beats and ongoing share gains with hyperscalers, setting up for another positive surprise. The new ES1500 networking switch provides a strong future growth narrative that should boost investor sentiment and lead to positive forward earnings revisions.