CMI Stock Recent News

CMI LATEST HEADLINES

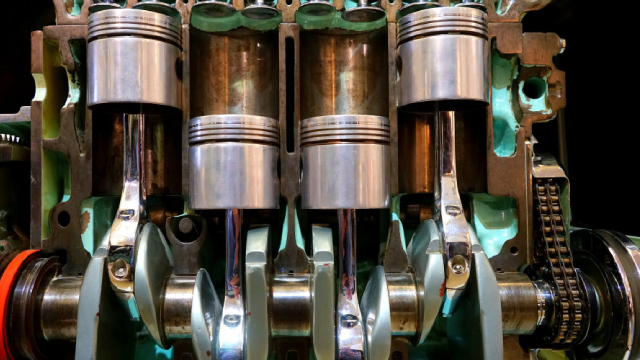

Engine maker Cummins (CMI) on Monday withdrew its 2025 outlook, citing uncertainty about the potential impact of the Trump administration's tariffs.

CMI reports better-than-expected first-quarter results, wherein revenues decline year over year.

While the top- and bottom-line numbers for Cummins (CMI) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Cummins (CMI) came out with quarterly earnings of $5.96 per share, beating the Zacks Consensus Estimate of $4.82 per share. This compares to earnings of $5.10 per share a year ago.

Cummins withdrew its annual forecast on Monday, joining other vehicle manufacturers that are reassessing expectations as the industry grapples with the mounting uncertainty generated by U.S. President Donald Trump's sweeping import tariffs.

COLUMBUS, Ind.--(BUSINESS WIRE)--Cummins Inc. (NYSE: CMI) today reported results for the first quarter of 2025. “The company delivered strong financial results in the first quarter of 2025 led by record performance in our Power Systems Segment,” said Jennifer Rumsey, Chair and CEO. “I want to thank our global employees for their commitment to delivering for our customers in an increasingly challenging environment. Due to growing economic uncertainty driven by tariffs we have withdrawn our full.

NEW YORK CITY, NY / ACCESS Newswire / May 4, 2025 / Bronstein, Gewirtz & Grossman, LLC is investigating potential claims on behalf of purchasers of Cummins Inc. ("Cummins" or "the Company") (NYSE: CMI). Investors who purchased Cummins securities prior to April 30, 2019, and continue to hold to the present, are encouraged to obtain additional information and assist the investigation by visiting the firm's site: bgandg.com/CMI.

NEW YORK CITY, NY / ACCESS Newswire / May 1, 2025 / Bronstein, Gewirtz & Grossman, LLC is investigating potential claims on behalf of purchasers of Cummins Inc. ("Cummins" or "the Company") (NYSE: CMI). Investors who purchased Cummins securities prior to April 30, 2019, and continue to hold to the present, are encouraged to obtain additional information and assist the investigation by visiting the firm's site: bgandg.com/CMI.

Get a deeper insight into the potential performance of Cummins (CMI) for the quarter ended March 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

NEW YORK CITY, NY / ACCESS Newswire / April 29, 2025 / Bronstein, Gewirtz & Grossman, LLC is investigating potential claims on behalf of purchasers of Cummins Inc. ("Cummins" or "the Company") (NYSE: CMI). Investors who purchased Cummins securities prior to April 30, 2019, and continue to hold to the present, are encouraged to obtain additional information and assist the investigation by visiting the firm's site: bgandg.com/CMI.