COIN Stock Recent News

COIN LATEST HEADLINES

BTM banks on kiosk expansion while COIN leans on stablecoins and acquisitions - which stock is set to ride on crypto momentum? Let's find out.

Remote-First-Company/CHICAGO--(BUSINESS WIRE)--Coinbase Global, Inc. announced today that Alesia Haas, Chief Financial Officer, will participate in a fireside chat at Citi's 2025 Global TMT Conference on Wednesday, September 3, 2025 at 2:50 pm ET / 11:50 am PT. A live webcast and replay of the virtual session will be available on Coinbase's Investor Relations website at https://investor.coinbase.com. Disclosure Information In addition to filings with the Securities and Exchange Commission, Coin.

How a business generates its revenue should be the first consideration for any investor considering a potential investment in a stock, especially in today's uncertain world, marked by geopolitical conflicts and ongoing trade tariff negotiations. For this reason, understanding where risk appetites are headed is a key gauge for identifying the next potential “cash cow” in the market, so to speak.

On August 15, 2025, HAP Trading disclosed a buy of Coinbase (COIN 0.23%) shares, with an estimated transaction value of $25,114,820.

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

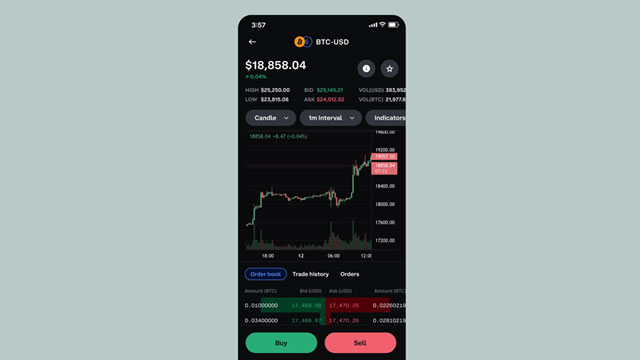

NEW YORK--(BUSINESS WIRE)--World Liberty Financial (“WLFI”) announced that USD1, the world's fastest-growing stablecoin, is now available on Coinbase (NASDAQ: COIN). USD1's availability on Coinbase marks a major milestone in WLFI's plan to make its stablecoin technology globally accessible to institutional and retail users alike. Users on Coinbase will now have the ability to access USD1 through coinbase.com and Coinbase iOS and Android apps. “As the first and largest publicly traded digital as.

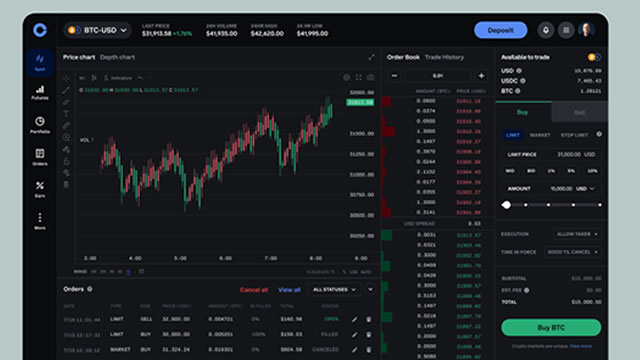

COIN's targeted acquisitions are broadening its capabilities, diversifying revenues, and expanding its geographical presence.

Fintechs are selling off during a sleepy week on Wall Street. The Nasdaq Composite index and the largest fintech ETF are both down.

Coinbase's $2.9B Deribit buyout boosts its crypto derivatives push, diversifies revenues, and sharpens its edge against rivals.

Coinbase Global (COIN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.