CR Stock Recent News

CR LATEST HEADLINES

Live Updates Live Coverage Has Ended S&P 500 Extends Its Winning Streak 4:18 pm The S&P 500 closed up 0.6% for Tuesday, extending its winning streak to six straight days. Trade Talks Keep S&P 500 Moving Higher 1:51 pm “Ask, and ye shall receive.” Investors for example have been asking a lot lately, for proof that President Trump’s tariffs threats will result in trade deals that can benefit the U.S. economy. Today, Treasury Secretary Scott Bessent announced that the conclusion of a trade deal with India is almost set now, with deals with both Japan and South Korea likely to follow in short order. That’s exactly what investors wanted to hear. The S&P 500 is now up 0.7%, and so is “the Voo.” Trump Growls, Amazon Caves 12:13 pm Well, that was quick! No sooner had the White House expressed disapproval of an Amazon plan to inform customers of how much tariffs were raising the cost of goods sold on its site, than Amazon has abandoned the pla

STAMFORD, Conn.--(BUSINESS WIRE)--Crane Company (NYSE: CR) announces the following schedule and teleconference information for its first quarter 2025 earnings release: Earnings Release: April 28, 2025 after close of market by public distribution and the Crane Company website at www.craneco.com. Teleconference: April 29, 2025 at 10:00 AM (Eastern) hosted by Max H. Mitchell, President & CEO, Alex Alcala, Executive Vice President & COO, and Richard A. Maue, Executive Vice President & C.

LONDONDERRY TOWNSHIP, Pa.--(BUSINESS WIRE)--Five months after announcing plans to restart Three Mile Island Unit 1 and launch the Crane Clean Energy Center, Constellation is ahead of schedule.

Crane Company NYSE: CR stock is up more than 100% since its separation from Crane NXT NYSE: CXT and can continue to rise by another triple-digit. The rise in stock price is driven by the company's growth, positioning, margin, cash flow, and capital return outlook, which is robust.

WALTHAM, Mass., Jan. 15, 2025 (GLOBE NEWSWIRE) -- Crane NXT, Co. (NYSE: CXT), a premier industrial technology company, today announced its schedule for the company's fourth quarter and full year 2024 results.

WALTHAM, Mass., Jan. 07, 2025 (GLOBE NEWSWIRE) -- Crane NXT, Co. (NYSE: CXT), a premier industrial technology company, announced that Aaron Saak, President and Chief Executive Officer, and Christina Cristiano, Senior Vice President and Chief Financial Officer, will participate in a fireside chat at the CJS Securities 25th Annual New Ideas for the New Year Conference on Tuesday, January 14, 2025 at 8:00 a.m. ET.

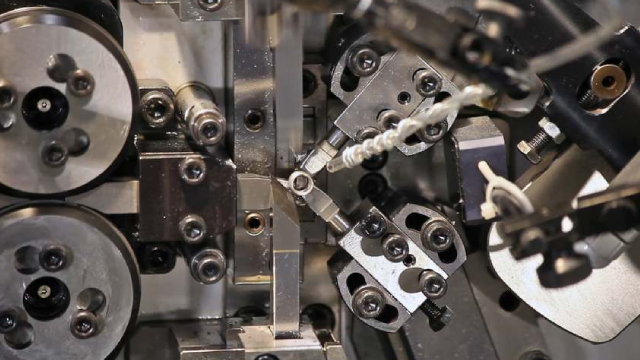

STAMFORD, Conn.--(BUSINESS WIRE)--Crane Company (NYSE:CR) (“Crane” or the “Company”), a premier industrial manufacturing and technology company, today announced that it has closed on the previously announced divestiture of its Engineered Materials business to KPS Capital Partners, LP (“KPS”). About Crane Company Crane Company has delivered innovation and technology-led solutions to its customers since its founding in 1855. Today, Crane is a leading manufacturer of highly engineered components f.

AGL, AMPH and CR have been added to the Zacks Rank #24 (Strong Sell) List on December 31, 2024.

Investors interested in stocks from the Manufacturing - General Industrial sector have probably already heard of Generac Holdings (GNRC) and Crane (CR). But which of these two companies is the best option for those looking for undervalued stocks?

ICLR, BHP and CR have been added to the Zacks Rank #5 (Strong Sell) List on December 20, 2024.