CSCO Stock Recent News

CSCO LATEST HEADLINES

CSCO's surging AI infrastructure orders, led by web-scale clients and strategic partnerships, highlight its drive to capture the booming AI market.

Q2 Metals Corp (TSX-V:QTWO) is preparing its first exploration target for the Cisco lithium project in Quebec. The Vancouver, BC-based company is estimating there could be between 215 and 329 million tonnes of rock containing 1% to 1.38% lithium oxide (Li₂O) at the target.

LUXEMBOURG--(BUSINESS WIRE)-- #WiFi--Cisco Systems, Inc has become the latest licensee of the Sisvel Wi-Fi 6 patent pool programme. The deal, which was reached on an amicable basis, provides Cisco with one-stop access to close to 2,000 patents (245 patent families) recognised to date, through the pool's process of independent patent evaluations, as essential to the 802.11ax Wi-Fi 6 standard. Cisco is the worldwide technology leader that is revolutionising the way organisations connect and protect in th.

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Three maximum-severity vulnerabilities allow unauthenticated remote attackers to gain complete system control Three maximum-severity vulnerabilities allow unauthenticated remote attackers to gain complete system control

The Dow Jones Industrial Average comprises 30 blue chip stocks that investors often regard as a proxy for the overall economy. Amidst that prominence, all but two of the 30 components return cash to shareholders, a move that tends to affirm that stability.

In the latest trading session, Cisco Systems (CSCO) closed at $68.3, marking a +1.38% move from the previous day.

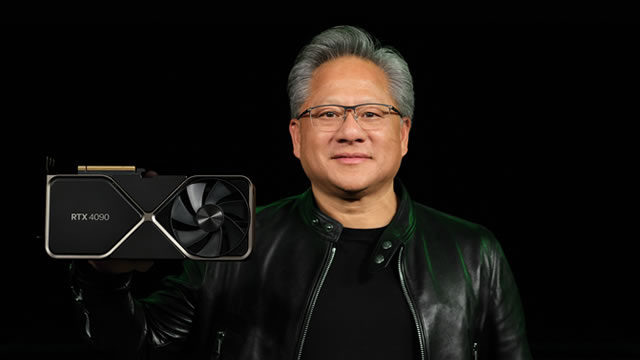

Nvidia's (NASDAQ: NVDA) meteoric rise, driven by the artificial intelligence (AI) boom, has sparked concerns that the stock might crash, similar to what happened to Cisco (NASDAQ: CSCO) during the 2000 Dot-Com bubble.

Recently, Zacks.com users have been paying close attention to Cisco (CSCO). This makes it worthwhile to examine what the stock has in store.

Cisco Systems (CSCO) closed at $67.95 in the latest trading session, marking a -1.18% move from the prior day.