CSGP Stock Recent News

CSGP LATEST HEADLINES

Investors interested in stocks from the Computers - IT Services sector have probably already heard of Epam (EPAM) and CoStar Group (CSGP). But which of these two companies is the best option for those looking for undervalued stocks?

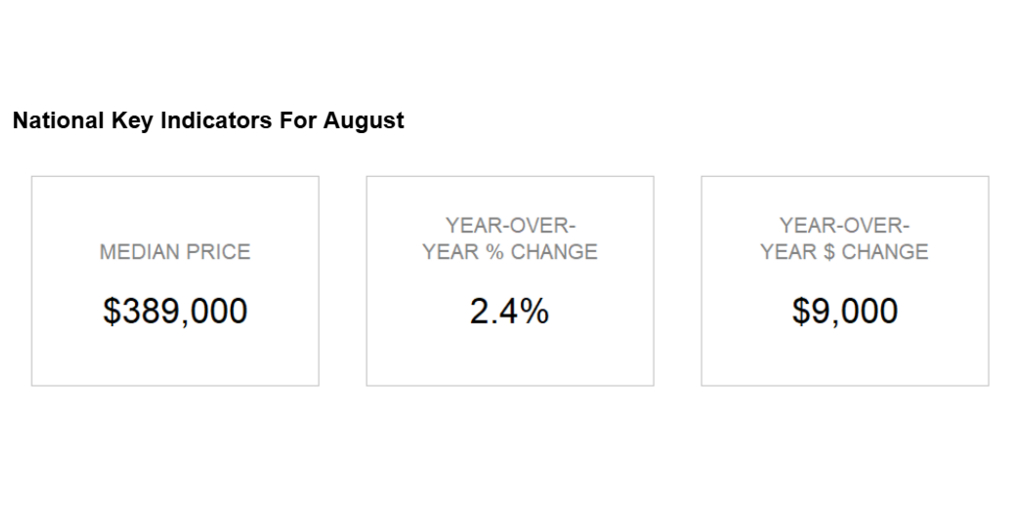

ARLINGTON, Va.--(BUSINESS WIRE)--Homes.com, a CoStar Group leading online residential marketplace, released a new report today analyzing home price trends in August (based on the data collected to date), including price trends across major metros and house types. Preliminary price data show U.S. home price growth remained muted in August, with the national median home price rising just 2.4% year-over-year to $389,000. While this marks an increase of $9,000 from last August, prices remain below.

CoStar (CSGP) reported earnings 30 days ago. What's next for the stock?

ARLINGTON, Va.--(BUSINESS WIRE)--Today Apartments.com, an industry-leading online marketplace of CoStar Group (NASDAQ: CSGP), published an in-depth report on multifamily rent trends for July 2025. U.S. apartment rent growth continued to slow throughout the month, with the national average holding at $1,717, unchanged from June. The month-over-month change was a negligible -0.03%, marking the sixth straight month of flat or negative monthly growth. Annual rent growth has also slowed, from 1.5% i.

ARLINGTON, Va.--(BUSINESS WIRE)--Homes.com, a CoStar Group leading online residential marketplace, released a new report today analyzing home price trends in July (based on the data collected to date), including price trends across major metros and house types. Preliminary price data for June showed a 2.1% increase in the median home price nationally, consistent with this year's trend of moderating home price growth. Over the past six months, year-over-year price growth has averaged 2.0%, down.

CoStar files lawsuit against Zillow claiming systematic copyright infringement of photographs distributed across Zillow's network. Many of the images have the CoStar watermark.

This story originally appeared on Real Estate News.

Zillow was sued on Wednesday by real estate information provider CoStar Group , which accused the largest U.S. online real estate portal of publishing at least 46,979 copyrighted photos without permission.

NEW YORK--(BUSINESS WIRE)--CoStar Group, Inc. (NASDAQ: CSGP), a global leader in commercial real estate information, analytics, online marketplaces and 3D digital twin technology, filed a lawsuit in New York federal court today alleging rampant copyright infringement by Zillow. The infringement could hardly be more brazen. The complaint shows that Zillow is unlawfully exploiting tens of thousands of CoStar Group's watermarked photographs on its sites and on Redfin and Realtor.com, making this o.

ARLINGTON, Va.--(BUSINESS WIRE)--CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information, analytics, and 3D digital twin technology in the property markets, announced today the appointment of Grant Montgomery as National Director of Multifamily Analytics. The hire will augment the company's already powerful analytics across the U.S. multifamily sector, adding value for CoStar Group clients and the commercial real estate industry as a whole. In his n.