CW Stock Recent News

CW LATEST HEADLINES

Curtiss-Wright Corporation (NYSE:CW ) Gabelli Funds' 31st Annual Aerospace & Defense Symposium September 4, 2025 2:15 PM EDT Company Participants Lynn Bamford - CEO & Chairman K. Farkas - VP & CFO Conference Call Participants George Bancroft - Gabelli Funds, LLC Presentation George Bancroft Member of Investment Research Advisory Committee Okay.

DAVIDSON, N.C.--(BUSINESS WIRE)---- $CW--Curtiss-Wright Corporation (NYSE: CW) today announced that Lynn M. Bamford, Chair and Chief Executive Officer, and K. Christopher Farkas, Vice President and Chief Financial Officer, will participate in three upcoming investor conferences and conduct meetings with members of the investment community, including: Deutsche Bank 15th Annual Aviation Forum, September 4, 2025, where the Company will host one-on-ones and group meetings; Gabelli Funds 31st Annual Aerospa.

HUNTSVILLE, Ala. , Aug. 12, 2025 /PRNewswire/ -- Radiance Technologies (Radiance) is pleased to announce the appointment of Mr.

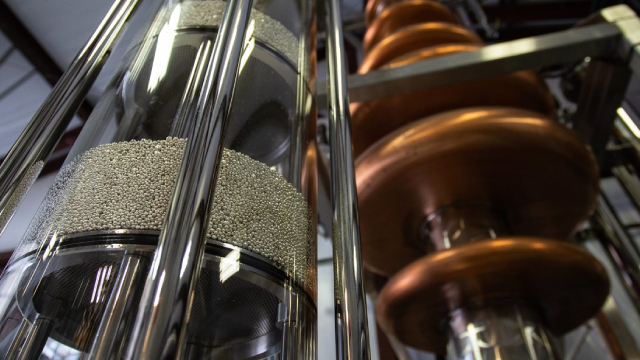

CW's rising nuclear aftermarket sales, strong returns and low debt make it a standout performer in aerospace defense equipment.

Lynn Bamford, Curtis Wright CEO, joins 'Closing Bell Overtime' to talk demand for commercial nuclear power, defense spending, quarterly results, and more.

DAVIDSON, N.C.--(BUSINESS WIRE)---- $CW #CWPoweredFromWithin--Curtiss-Wright Corporation (NYSE: CW) today announced a $200 million expansion of its 2025 share repurchase program, which is now expected to result in annual share repurchases of $266 million in 2025. “We are pleased to announce this new $200 million expansion of our 2025 repurchase program and increase to our annual share buyback commitment,” said Lynn M. Bamford, Chair and Chief Executive Officer of Curtiss-Wright Corporation. “As evidenced by the recent incr.

ASHBURN, Va.--(BUSINESS WIRE)---- $CW--Curtiss-Wright today announced it has been selected by Rheinmetall Landsysteme Germany (RLS) to provide its modular turret drive stabilization system (TDSS) technology in support of the KF51 Panther Main Battle Tank (MBT). The KF51, a highly advanced and capable main battle tank, is designed to meet the demands of modern warfare. Curtiss-Wright's highly precise, modular TDSS system is an ideal match for these newly modernized platform requirements. Work under this.

Curtiss-Wright Corporation (NYSE:CW ) Q2 2025 Earnings Conference Call August 7, 2025 10:00 AM ET Company Participants James M. Ryan - Vice President of Investor Relations K.

While the top- and bottom-line numbers for Curtiss-Wright (CW) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Curtiss-Wright (CW) came out with quarterly earnings of $3.23 per share, beating the Zacks Consensus Estimate of $3.13 per share. This compares to earnings of $2.67 per share a year ago.