CWEN Stock Recent News

CWEN LATEST HEADLINES

Clearway Energy (CWEN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

The energy sector can be a great source of dividend income. Many energy companies pay lucrative dividends backed by strong financial profiles.

Clearway Energy (CWEN) closed the most recent trading day at $31.46, moving 1.01% from the previous trading session.

In the most recent trading session, Clearway Energy (CWEN) closed at $32.98, indicating a +1.95% shift from the previous trading day.

The S&P 500 's (^GSPC -0.33%) dividend yield is approaching record lows at around 1.2%. However, that doesn't mean passive income seekers are out of luck.

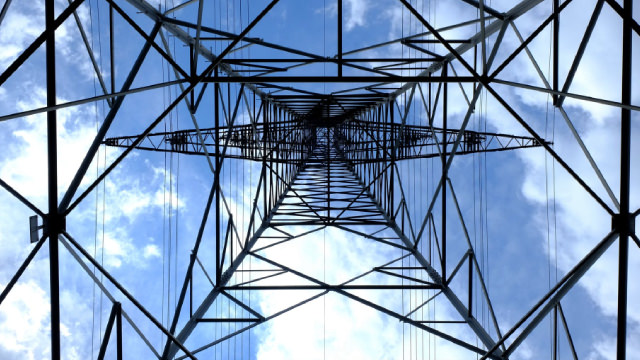

Tariff risks are underappreciated by the market; persistently high tariffs could weigh on economic growth, and investor complacency is unwarranted. Slowing population growth and deportations threaten U.S. economic expansion, especially in labor-dependent sectors, as immigration is key to workforce and consumption growth. Utility-scale renewables remain resilient despite policy headwinds, with cost competitiveness and strong demand from major tech firms supporting continued growth.

Clearway Energy (CWEN) reached $31.87 at the closing of the latest trading day, reflecting a -1.18% change compared to its last close.

PRINCETON, N.J., July 10, 2025 (GLOBE NEWSWIRE) -- Clearway Energy, Inc. (NYSE: CWEN, CWEN.A) plans to report Second Quarter 2025 financial results on Tuesday, August 5, 2025. Management will present the results during a conference call and webcast at 5:00 p.m. Eastern.

Clearway Energy (CWEN) reached $31.97 at the closing of the latest trading day, reflecting a +1.3% change compared to its last close.

NGD, GECC, MITSY, CWEN and PDEX have been added to the Zacks Rank #1 (Strong Buy) List on July 1, 2025.