CYD Stock Recent News

CYD LATEST HEADLINES

SINGAPORE , Aug. 25, 2025 /PRNewswire/ -- China Yuchai International Limited (NYSE: CYD) ("China Yuchai" or the "Company"), wishes to announce that one of its indirect subsidiaries is considering a potential listing (the "Potential Listing Subsidiary") on a foreign stock exchange (the "Potential Listing"). The Potential Listing Subsidiary has commenced preparatory work for the purposes of the Potential Listing.

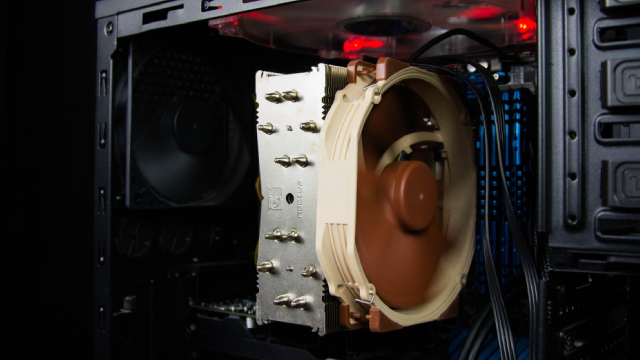

SINGAPORE , Aug. 25, 2025 /PRNewswire/ -- China Yuchai International Limited (NYSE: CYD) ("China Yuchai" or the "Company"), one of the largest powertrain solution manufacturers through its main operating subsidiary in China, Guangxi Yuchai Machinery Company Limited ("Yuchai"), announced that MTU Yuchai Power Co., Ltd. ("MYP") successfully launched the first batch of the mtu Series 2000 engine.

I remain bullish on China Yuchai, as the firm should continue to perform well for the rest of 2025 and beyond. CYD's full-year outlook is positive, considering trade-in incentives for Chinese trucks and the company's market share gains. Intermediate-term growth is supported by CYD's data center engine business and overseas ventures, particularly in Southeast Asia.

TLN, CYD and MGIC made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on August 18, 2025.

Here is how China Yuchai (CYD) and Douglas Dynamics (PLOW) have performed compared to their sector so far this year.

ENVA, PDS and CYD made it to the Zacks Rank #1 (Strong Buy) value stocks list on August 18, 2025.

MLCO, CYD, HMY, E and KE have been added to the Zacks Rank #1 (Strong Buy) List on August 18, 2025.

SINGAPORE , Aug. 18, 2025 /PRNewswire/ -- China Yuchai International Limited (NYSE: CYD) ("China Yuchai" or the "Company"), one of the largest powertrain solution manufacturers through its main operating subsidiary in China, Guangxi Yuchai Machinery Company Limited ("Yuchai"), announced today that the first batch of buses powered by Yuchai's natural gas engines was recently delivered to Nuevo León, Mexico, providing a stable and reliable power source to public buses for upgrading the local public transportation system. This batch is the first shipment under the 600-unit natural gas bus order received in 2024.

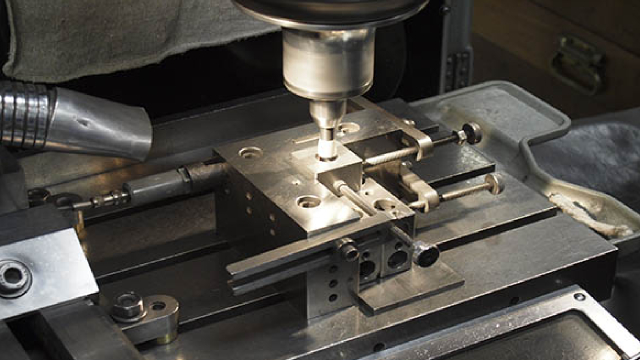

SINGAPORE , Aug. 13, 2025 /PRNewswire/ -- China Yuchai International Limited (NYSE: CYD) ("China Yuchai" or the "Company") one of the largest powertrain solution manufacturers through its main operating subsidiary in China, Guangxi Yuchai Machinery Company Limited ("Yuchai"), announced today that Yuchai's subsidiary, Guangxi Yuchai Foundry Co., Ltd. ("Yuchai Foundry"), had in early August commenced the shipment of its first batch of a total order for 30,000 high-end cylinder head castings to a German customer.

China Yuchai International Limited (NYSE:CYD ) Q1 2025 Earnings Conference Call August 8, 2025 8:00 AM ET Company Participants Choon Sen Loo - Chief Financial Officer Kevin Theiss - Head of Investor Relations Tak Chuen Lai - General Manager of Operations Weng Ming Hoh - President & Director Conference Call Participants Don Espey - Shah Capital Management, Inc Junhao Li - Daiwa Securities Co. Ltd., Research Division Wei Shen - UBS Investment Bank, Research Division Yiming Liu - Haitong Securities Co., Ltd.