D Stock Recent News

D LATEST HEADLINES

Now is a good time to be choosy when it comes to quality dividend stocks. I highlight two stocks that offer resilient cash flow streams in two distinct industries. Both carry BBB+ rated balance sheets and offer dividend yields averaging 6%.

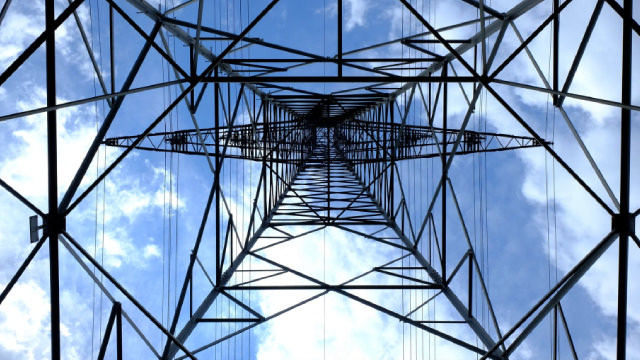

Utility stocks were once called "widows and orphans" stocks because they were considered so safe and boring. That image isn't far from the view today, noting that utilities are generally looked at as reliable dividend stocks.

RICHMOND, Va.--(BUSINESS WIRE)--Dominion Energy (NYSE: D) will host its second-quarter 2025 earnings call at 10 a.m. ET on Friday, August 1, 2025. Management will discuss matters of interest to financial and other stakeholders including recent financial results. A live webcast of the conference call, including accompanying slides and other financial information, will be available on the investor information pages at investors.dominionenergy.com. For individuals who prefer to join via telephone,.

The recent stock market rally has many investors focused on the S&P 500 index, which recently made a new all-time high. The SPDR S&P 500 ETF Trust NYSEARCA: SPY is up 5.3% in 2025.

For investors aiming to build a nuclear-focused portfolio, companies like Entergy, Dominion Energy, and Constellation Energy present compelling opportunities.

RICHMOND, Va.--(BUSINESS WIRE)--Dominion Energy (NYSE: D) today announced the promotion of Edward H. “Ed” Baine to executive vice president-Utility Operations and president-Dominion Energy Virginia. Baine has been leading Utility Operations – consisting of Dominion Energy Virginia and Dominion Energy South Carolina, together serving more than 4 million customer accounts – since Jan. 1, 2025, as president, and has led Dominion Energy Virginia as president since 2020. The promotion will take effe.

Dominion Energy (D) concluded the recent trading session at $55.87, signifying a +1.25% move from its prior day's close.

Geopolitical tensions have been high. Tariff uncertainty could also upend the economy and market.

RICHMOND, Va.--(BUSINESS WIRE)--Dominion Energy, Inc. (NYSE: D), announced that the company's board of directors has elected a new independent director, Jeffrey J. “Jeff” Lyash, effective today, June 25. The election is part of Dominion Energy's ongoing commitment to strong corporate governance and regular refreshment of its board of directors. The company has added seven new directors since 2019, with an average tenure for the entire board of 7.4 years. Lyash, 63, will serve on the board's Saf.

Stocks—especially dividend stocks—have every reason to shoot higher from here. In fact, they have 7 trillion reasons.