ENPH Stock Recent News

ENPH LATEST HEADLINES

ENPH boosts global reach with IQ Battery expansion, new product launches and strong year-over-year shipment growth.

ENPH shares slump 28.2% in three months amid weak demand, higher costs and policy changes pressuring growth.

FREMONT, Calif., Aug. 11, 2025 (GLOBE NEWSWIRE) -- Enphase Energy, Inc. (NASDAQ: ENPH), a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, today announced the launch of the IQ® Battery 5P™ with FlexPhase for customers in Australia. The IQ Battery 5P with FlexPhase is an all-in-one AC-coupled system that delivers reliable backup power and supports both single-phase and three-phase applications with variable power levels, offering flexibility to meet diverse home energy needs.

Zacks.com users have recently been watching Enphase Energy (ENPH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Enphase Energy's strong balance sheet and net cash position set it apart in the solar sector, providing resilience amid current market headwinds. Recent earnings showed a double beat and stable margins, while management's share repurchases signal confidence in long-term value. A major catalyst is anticipated interest rate cuts, which could reignite U.S. residential solar demand and magnify Enphase's recovery potential.

Enphase and SolarEdge face short-term headwinds from unfavorable regulations and higher rates, but long-term structural tailwinds remain strong. Both companies are innovating with distributed energy solutions—AI, battery storage, microgrids, and EV integration—positioning themselves as future leaders in energy distribution. Long-term drivers, such as electrification, rising electricity demand and prices, declining battery costs, and the decentralization of energy networks could significantly boost growth and resilience.

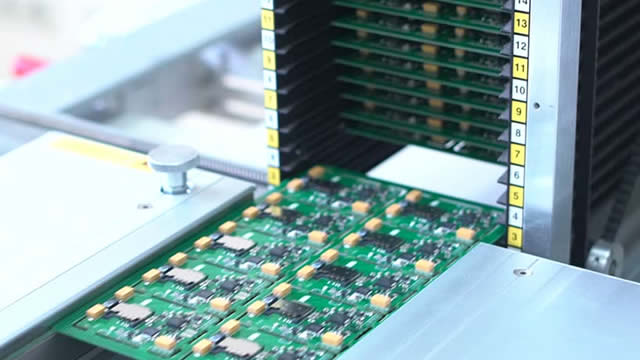

FREMONT, Calif., July 29, 2025 (GLOBE NEWSWIRE) -- Enphase Energy, Inc. (NASDAQ: ENPH), a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, today announced the launch of the 4th-generation Enphase® Energy System, featuring the IQ® Battery 10C, IQ® Meter Collar, and the IQ® Combiner 6C. This next-generation system stands out for its smaller footprint, enhanced features, easier installation, and unmatched reliability. Watch a video about the new Enphase system here.

Enphase Energy (ENPH) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

FREMONT, Calif., July 24, 2025 (GLOBE NEWSWIRE) -- Enphase Energy, Inc. (NASDAQ: ENPH), a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, today announced that it is continuing to expand its product offering in Europe to meet the needs of customers with initial shipments of IQ8P™ Microinverters, with peak output AC power of 480 W, in Italy and Switzerland to support newer, high-powered solar modules.

Enphase Energy, Inc. ENPH CEO Badri Kothandaraman on Tuesday addressed the changes underway in the solar energy market, triggered by evolving incentive structures, and how Enphase plans to respond.