ENR Stock Recent News

ENR LATEST HEADLINES

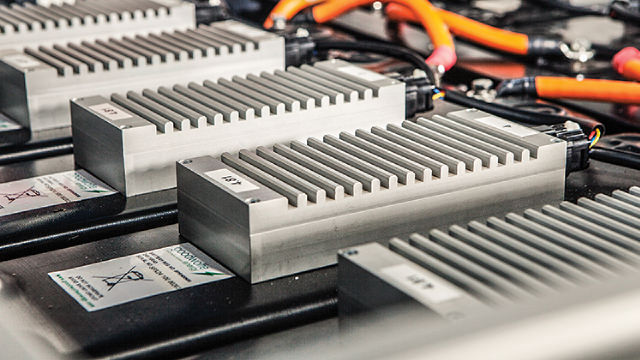

The global electric vehicle (EV) market is experiencing unprecedented growth, driven by multiple factors, including stringent government regulations aimed at reducing carbon emissions, increasing environmental awareness among consumers, and rapid advancements in battery technology. This surge in EV adoption is significantly impacting the US battery component industry, creating a sector ripe with investment opportunities.

Energizer focuses on growth, operational efficiency and e-commerce expansion, positioning itself for sustained long-term success.

New packaging hits Walmart stores in March, nationwide expansion to follow ST. LOUIS , Jan. 28, 2025 /PRNewswire/ -- Energizer Holdings, Inc. (NYSE: ENR), one of the world's largest manufacturers and distributors of primary batteries, today announced the launch of 100% recyclable plastic-free packaging* for its portfolio of Energizer® batteries.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Energizer Holdings, despite recent financial struggles, remains a strong player in the battery market with promising future prospects and an attractive stock price. Management's strategic initiatives, including Project Momentum, aim to improve margins and reduce debt, with significant cost-saving measures already underway. Revenue and profits are expected to rise in 2025, supported by new product launches and ongoing investments in growth initiatives.

ST. LOUIS , Jan. 24, 2025 /PRNewswire/ -- Energizer Holdings, Inc. (NYSE: ENR) announced that its Board of Directors declared a dividend on its common stock of $0.30 per share. The dividend will be payable on March 13, 2025 to shareholders of record as of the close of business on February 20, 2025.

Here is how Energizer Holdings (ENR) and Reeds (REED) have performed compared to their sector so far this year.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

ST. LOUIS , Jan. 10, 2025 /PRNewswire/ -- Energizer Holdings, Inc. (NYSE: ENR) will report its First Quarter Fiscal Year 2025 results before the market opens on February 4. Energizer also will discuss its results during an investor conference call that will be webcast beginning at 10 a.m.

Energizer shows resilience through operational improvements, margin growth and strategic investments in market expansion and e-commerce.