EQT Stock Recent News

EQT LATEST HEADLINES

EQT Corp. EQT released its second-quarter results after Tuesday's closing bell. Here's a look at the details from the report.

PITTSBURGH , July 22, 2025 /PRNewswire/ -- EQT Corporation (NYSE: EQT) today announced financial and operational results for the second quarter of 2025. Second Quarter 2025 Results: Production: Sales volume of 568 Bcfe, at the high-end of guidance driven by strong well performance and compression project outperformance, underscoring continued synergy capture momentum from the Company's acquisition of Equitrans Midstream Corporation (the Equitrans Midstream Merger) Capital Expenditures: $554 million, 15% below the mid-point of guidance due to continued efficiency gains and midstream project optimization Realized Pricing: Differential in-line with mid-point of guidance despite much wider-than-expected local basis as tactical curtailment strategy continues to optimize value Operating Costs: Total per unit operating costs of $1.08 per Mcfe, below the low-end of guidance driven by lower-than-expected LOE and SG&A expense Cash Flow: Net cash provided by operating activities of $1,242 mill

The Investment Committee give you their top stocks to watch for the second half.

Norwegian online classifieds group Adevinta said on Monday it had sold its Spanish business to Swedish private equity firm EQT , to focus more on the rest of its European units for an undisclosed amount.

Margin pressures and pipeline bottlenecks are likely to have weighed on EQT's Q2 earnings.

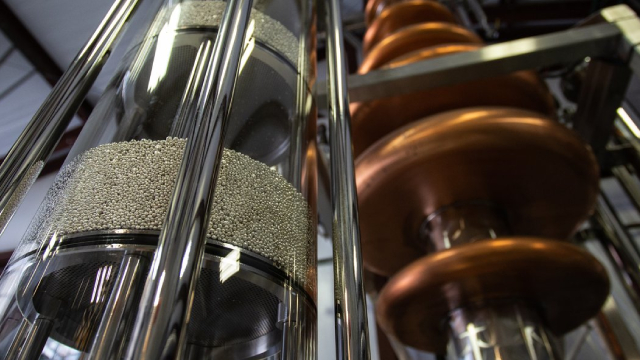

PITTSBURGH , July 16, 2025 /PRNewswire/ -- EQT Corporation (NYSE: EQT) today announced that its Board of Directors declared a quarterly cash dividend on its common stock of $0.1575 per share, payable on September 2, 2025, to shareholders of record at the close of business on August 6, 2025. Investor Contact Cameron Horwitz Managing Director, Investor Relations & Strategy412.445.8454 Cameron.Horwitz@eqt.com About EQT Corporation EQT Corporation is a premier, vertically integrated American natural gas company with production and midstream operations focused in the Appalachian Basin.

EQT lands exclusive gas supply deal for AI-powered Homer City Energy Campus, a 3,200-acre data center overhaul of PA's largest former coal plant.

Following a careful analysis of the Zacks Oil and Gas - Exploration and Production - United States industry, we advise focusing on shares of EQT, APA, CIVI and WTI.

Toby Rice, EQT CEO, joins 'Fast Money' to talk EQT's AI energy infrastructure push in Pennsylvania.

INDIANA COUNTY, Pa.--(BUSINESS WIRE)--Homer City Redevelopment (“HCR”) today announced an agreement in principle (the “Agreement”) for EQT Corporation (NYSE: EQT) (“EQT”) to serve as HCR's exclusive partner to source and supply the natural gas needed to power the 4.4 gigawatt natural gas facility that will serve the Homer City Energy Campus — a 3,200 acre AI and high-performance computing (HPC) data center campus currently under construction and slated to begin producing power in 2027. The proj.