ESAB Stock Recent News

ESAB LATEST HEADLINES

ESAB Corporation's stock has risen over 35%, driven by improving growth outlook, strong execution, and potential M&As. The margin outlook is also positive driven by pricing increases, cost reductions, and a mix shift towards higher-margin equipment sales, with a target of 22%+ adjusted EBITDA margins by 2028. Trading at 23.84x FY25 EPS, ESAB is well-positioned for further P/E re-rating, making it a good buy given its growth prospects and solid execution.

The outlook of Zacks Metal Products - Procurement and Fabrication industry looks upbeat and stocks like NHYDY, ESAB, CENX and NWPX are worth keeping an eye on.

Investors with an interest in Metal Products - Procurement and Fabrication stocks have likely encountered both Norsk Hydro ASA (NHYDY) and Esab (ESAB). But which of these two stocks presents investors with the better value opportunity right now?

COLUMBIA, S.C.--(BUSINESS WIRE)--A South Carolina court has set a trial date of Feb. 3, 2025, to determine whether Anglo-American, PLC (OTCQX: NGLOY), ESAB Corp. (NYSE: ESAB) and billionaire businessman Mohed Altrad, among others, can be held responsible for billions of dollars of liabilities stemming from asbestos that Cape Asbestos sent to companies in the United States and South Carolina for decades. A court-appointed receiver in June 2023 filed suit against numerous entities including Anglo.

NORTH BETHESDA, Md.--(BUSINESS WIRE)---- $ESAB #3Q2024Earnings--ESAB Corporation Schedules Third Quarter 2024 Earnings Release and Conference Call.

Investors with an interest in Metal Products - Procurement and Fabrication stocks have likely encountered both AB SKF (SKFRY) and Esab (ESAB). But which of these two stocks offers value investors a better bang for their buck right now?

Investors interested in Metal Products - Procurement and Fabrication stocks are likely familiar with AB SKF (SKFRY) and Esab (ESAB). But which of these two stocks offers value investors a better bang for their buck right now?

NORTH BETHESDA, Md.--(BUSINESS WIRE)---- $ESAB #ESABCorporation--ESAB Corporation Board Declares Dividend.

NORTH BETHESDA, Md.--(BUSINESS WIRE)---- $ESAB #ESABCorporation--ESAB introduces FloCloud, a gas monitoring hardware and software solution that provides actionable data for industrial customers.

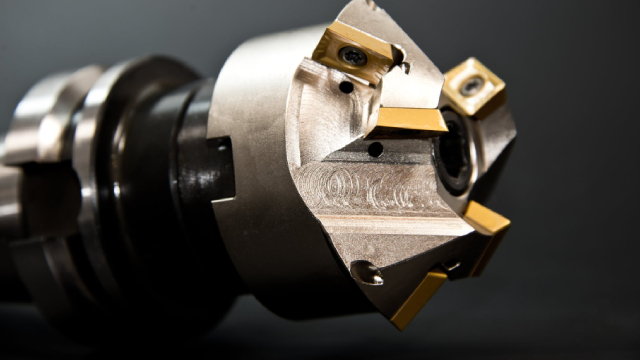

ESAB Corporation faces near-term challenges in key end markets but has strong long-term growth outlook in emerging markets and innovative product launches. Margin growth is expected from product line simplification, footprint rationalization, AI tools, and mix shift towards higher margin equipment sales. Revenue growth supported by organic and inorganic strategies, with focus on emerging markets, reshoring trend, and infrastructure upgrades.