FAST Stock Recent News

FAST LATEST HEADLINES

WINONA, Minn.--(BUSINESS WIRE)--Fastenal Company (Nasdaq:FAST) ('Fastenal', 'we', 'our', or 'us') reported its board of directors declared a dividend of $0.22 per share to be paid in cash on August 26, 2025 to shareholders of record at the close of business on July 29, 2025. Except for share and per share information, dollar amounts are stated in millions. Share and per share information in this release has been adjusted to reflect a previously announced two-for-one stock split which took effec.

WINONA, Minn.--(BUSINESS WIRE)--Fastenal Company (Nasdaq: FAST) ('Fastenal', 'we', 'our', or 'us') is proud to announce the publication of our 2025 ESG Report. The report, which covers the year ending December 31, 2024, was produced with reference to the Global Reporting Initiative (GRI) standards and aligns with the ESG disclosure and reporting frameworks established by the Sustainability Accounting Standards Board (SASB, now part of the IFRS Foundation) and the Task Force on Climate-Related F.

FAST eyes 12% EPS growth in Q2, with strong daily sales and margin gains likely to fuel another solid earnings report.

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Fastenal (FAST), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2025.

Fastenal (FAST) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Asking 'why' repeatedly is crucial for investors to understand the root causes of macroeconomic shifts and avoid being blind sided by market disruptions. The current U.S. policy shift favors growth over inflation control, increasing risks of higher inflation and short-term debt refinancing challenges. Given these risks, I recommend increasing exposure to real assets, REITs, and cyclical value stocks for inflation protection and potential outperformance.

Fastenal Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Fastenal Company FAST will release earnings results for the second quarter, before the opening bell on Monday, July 14.

I track 50 high-quality dividend growth stocks to identify opportune investments, updating valuation ratings daily to focus on attractive opportunities. In this turbulent year, my investable universe kept up with SPY and outperformed SCHD year-to-date, with a gain of 5.63% compared to 5.72% and -2.13%. This month, 18 stocks had valuation rating changes; 5 were upgrades, including Paychex with an attractive expected return.

WINONA, Minn.--(BUSINESS WIRE)--Fastenal Company (Nasdaq:FAST) ('Fastenal', 'we', 'our', or 'us') announced the date and time for its conference call to review 2025 second quarter results, as well as current operations. The conference call will be broadcast live over the Internet on Monday, July 14, 2025 at 9:00 a.m. central time. To access the call, please visit the following Web address: https://investor.fastenal.com/events.cfm Our conference call presentation (which includes information, sup.

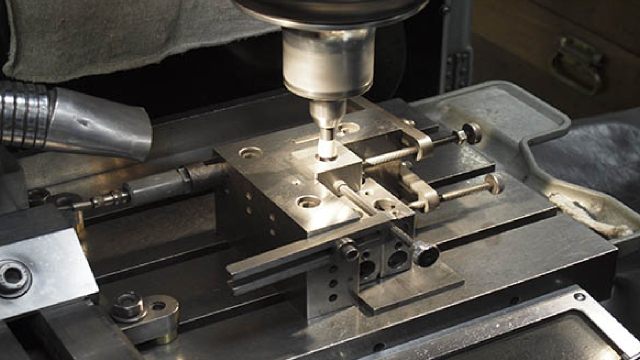

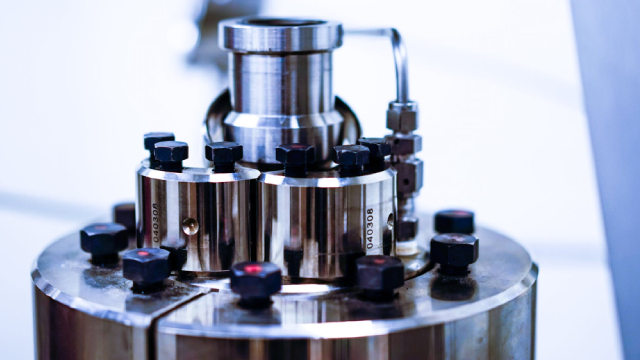

On the surface, Fastenal (FAST 0.55%), O'Reilly Automotive (ORLY -2.28%), and Interactive Brokers Group (IBKR 2.31%) might seem to have practically nothing in common. Fastenal is a leader in the distribution of industrial and construction supplies, especially fasteners.