FSLR Stock Recent News

FSLR LATEST HEADLINES

In the latest trading session, First Solar (FSLR) closed at $162.44, marking a -1.61% move from the previous day.

The July 7th Trump Executive Order on eliminating IRS tax credits does not include First Solar's Section 45X for now. The extended reciprocal tariff deadline into early August renews tariff risks, and I expect potential trade deals could still maintain a higher tariff rate, pressuring margins. 2Q FY2025 earnings could face added pressure on gross margin and EPS after Trump raised steel and aluminum tariffs to as much as 50% on June 4th.

Welcome to the Green Stock News brief for Thursday July 10th. Here are today's top headlines: MP Materials (NYSE: MP) has formed a major public-private partnership with the U.S. Department of Defense to rapidly expand a domestic rare earth magnet supply chain and reduce reliance on foreign sources.

The One Big Beautiful Bill (OBBB) Act is now law, and with it come several new rules and rollbacks that could weaken the clean energy industry in the U.S. While the bill's primary focus has been tax cut extensions, the legislation also eliminates many incentives for solar power, especially those in residential areas.

Live Updates Live Coverage Has Ended President Trump on Tariffs 1:03 pm by Gerelyn Terzo President Trump has delivered an update on tariff details. He said that the Aug. 1 deadline is a clarification, not a delay, while also commenting that some trade partners will be getting letters establishing tariff rates as high as 70%-80%. President Trump also acknowledged that trade talks with the EU were going swimmingly. The Nasdaq Composite has trimmed its gains to 0.12% on the day. TSLA: Worse Before It Gets Better 11:35 am by Gerelyn Terzo Morgan Stanley analyst Adam Jonas believes conditions could worsen for EV leader Tesla (Nasdaq: TSLA) before they improve due to CEO Elon Musk’s political leanings. TSLA shares are recouping some lost ground and are up 2.8% but remain down a steep 25% year-to-date. Bullish on Tech 10:15 am by Gerelyn Terzo Wells Fargo analysts are busy making calls on the tech industry today. Wells Fargo lifted its price target on Meta Platforms (Nasdaq: META) by $1

First Solar (FSLR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

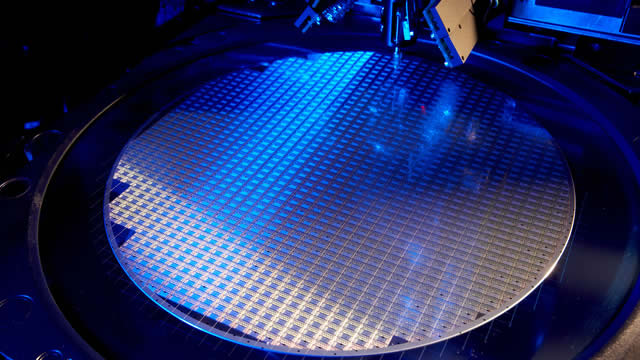

Additionally, the companies expanded their photovoltaic module R&D collaboration focused on optimizing performance of utility-scale solar LOS ALAMOS, N.M., July 9, 2025 /PRNewswire/ -- UbiQD®, a global leader in quantum dot (QD) nanotechnology, announced today that it has entered into an exclusive, multi-year agreement to supply its proprietary fluorescent QD technology to First Solar, Inc. (NASDAQ: FSLR).

FSLR is ramping up investment in perovskite tech with a new R&D line and aims to scale high-efficiency thin-film solar panels.

Solar stocks are sliding after the White House's latest moves to eliminate clean energy subsidies.

Solar stocks dropped on Tuesday after President Donald Trump signed an executive order to fast-track the end of clean-energy tax credits late Monday.