FXI Stock Recent News

FXI LATEST HEADLINES

Chinese mega caps and American financials take the focus of today's Big 3. @Theotrade's Don Kaufman explains why he's bearish on the iShares China Large-Cap ETF (FXI) and Goldman Sachs (GS) while maintaining bullishness on the iShares 20+ Year Treasury Bond ETF (TLT).

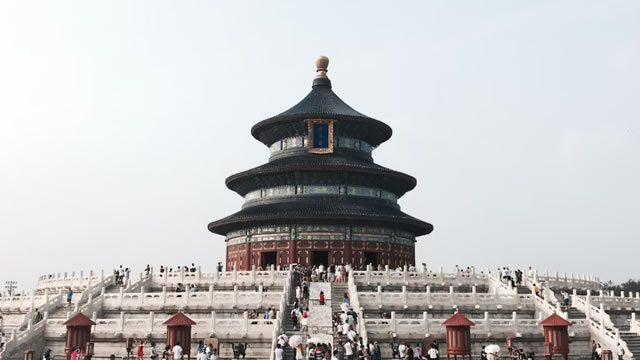

The Chinese stock market is on fire and the rally is gathering momentum—in stark contrast to U.S. equities right now.

Insight with Haslinda Amin, a daily news program featuring in-depth, high-profile interviews and analysis to give viewers the complete picture on the stories that matter. The show features prominent leaders spanning the worlds of business, finance, politics and culture.

CNBC's Seema Mody reports on news from the stock markets in China.

The Chinese stock market index fund, FXI, rose 59% YoY, driven by significant stimulus efforts and the launch of China's DeepSeek AI. FXI's performance is buoyed by its increased exposure to technology and consumer sectors, reducing its reliance on the struggling financial, industrial, and real estate sectors. Despite recent gains, I remain mildly bearish on FXI due to China's opaque financial system and the long-term risks of its debt-driven stimulus policies.

As President Trump widens his tariff threats to other nations and China backstops its economy, investors are dipping back into a market they once shunned.

Investors may want to reduce their exposure to the world's largest emerging market.

Trump's tariffs cause short-term volatility, but long-term market impact is minimal; earnings remain the key focus for investors. The three countries in questions are Canada, China, and Mexico. This blog dives into several major companies domiciled in one of those three countries. In the long-term scheme of things the fundamentals of the companies behind these ADRs and stocks are likely to be more deterministic than any geopolitical factors.

Several hedge funds are pouring money into Chinese equities on the DeepSeek buzz and the potential for the country's policy easing.

Three of the biggest Chinese ADRs in the US are mixed in premarket trading, and at this point in time, the market seems to see mixed momentum.