GGG Stock Recent News

GGG LATEST HEADLINES

Besides Wall Street's top -and-bottom-line estimates for Graco (GGG), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

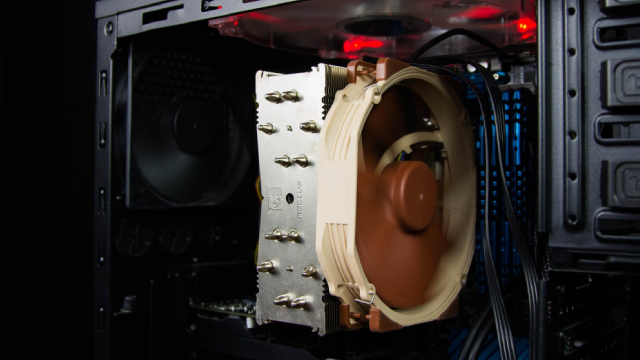

GGG's new EODD pump portfolio is used for various industrial and hygienic applications in modern factories.

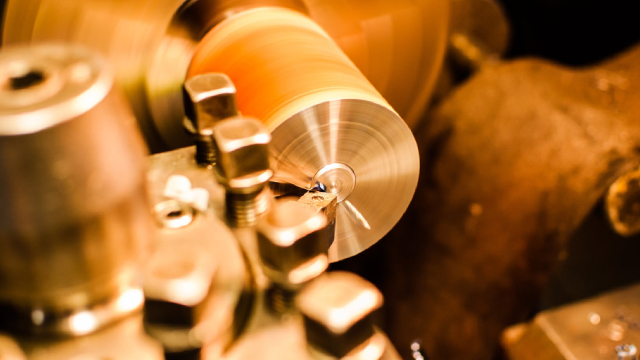

MINNEAPOLIS--(BUSINESS WIRE)--Graco Inc. (NYSE: GGG), a leading manufacturer of fluid handling equipment, today announced the expansion of its field-proven QUANTM™ line. This latest release signifies Graco's ongoing commitment to meet evolving customer needs and empower automated operations. With a focus on increased efficiency and reliability, the unique XTREME TORQUE motor design dramatically reduces the weight and size of the pump—and makes it far easier to deploy and maintain. The recently.

MINNEAPOLIS--(BUSINESS WIRE)--Graco Inc. (NYSE: GGG) announced today that it will release its First Quarter 2025 earnings after the New York Stock Exchange closes on Wednesday, April 23, 2025. A full-text copy of the earnings announcement will be available on the company's website at investors.graco.com. Graco management will hold a conference call, including slides via webcast, with analysts and institutional investors to discuss the results at 11 a.m. EDT / 10 a.m. CDT on Thursday, April 24,.

GGG gains from new product launches, accretive acquisitions and shareholder-friendly policies.

The article presents the highest-quality Dividend Champions, which are companies listed on U.S. exchanges that have consistently higher annual dividend payouts for at least 25 years. I use a quality scoring system with six quality indicators, each worth five points, for a maximum score of 30. The highest-quality Dividend Champions score four or five points for each quality indicator. Only 15 of 137 Dividend Champions made the list of highest-quality Dividend Champions.

I track 50 high-quality dividend stocks, updating their valuations daily to identify Strong Buy, Buy, Hold, and Trim opportunities based on historical free cash flow trends. Today, I will highlight 9 new stocks from the list that appear to be attractively positioned. I will present 3 unique valuations for each of these stocks.

Graco (GGG) reported earnings 30 days ago. What's next for the stock?

The headline numbers for Graco (GGG) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

MINNEAPOLIS--(BUSINESS WIRE)--The Board of Directors of Graco Inc. (NYSE:GGG) has declared a regular quarterly dividend of 27.5 cents ($0.275) per common share, payable on May 7, 2025, to shareholders of record at the close of business on April 14, 2025. The company has approximately 168.6 million shares outstanding. ABOUT GRACO Graco Inc. supplies technology and expertise for the management of fluids and coatings in both industrial and commercial applications. It designs, manufactures and mark.