GRMN Stock Recent News

GRMN LATEST HEADLINES

Garmin (GRMN) concluded the recent trading session at $235.96, signifying a -1.06% move from its prior day's close.

Investors with an interest in Electronics - Miscellaneous Products stocks have likely encountered both Hayward Holdings, Inc. (HAYW) and Garmin (GRMN). But which of these two companies is the best option for those looking for undervalued stocks?

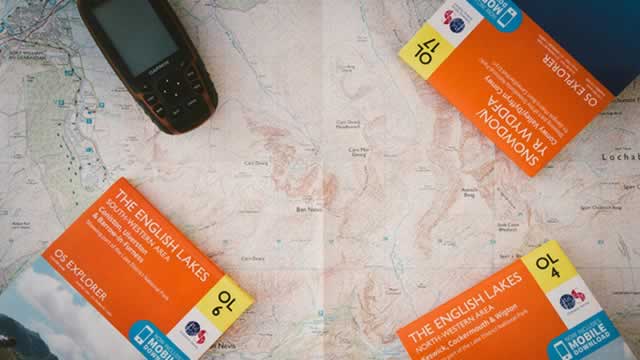

Plan, prepare and perform with advanced training features, custom nutrition and hydration alerts and more OLATHE, Kan. , Sept. 9, 2025 /PRNewswire/ -- Garmin (NYSE: GRMN) today announced the Edge® 550 and 850 , advanced and compact cycling computers built to help riders better prepare and train for an event or goal.

I track a universe of 50 high-quality dividend growth stocks to identify attractive investment opportunities based on valuation and future return potential. My custom valuation model highlights 23 stocks with estimated future returns above 10%, with 12 of these also appearing undervalued by free cash flow. Top picks include Resmed, MarketAxess, Ferrari, MSCI, Accenture, and others, each offering strong return estimates and solid business fundamentals.

Garmin (GRMN) reported earnings 30 days ago. What's next for the stock?

Advanced Avionics for a Next-Generation Regional xVTOL Aircraft ENGLEWOOD, Colo. , Aug. 21, 2025 /PRNewswire/ -- XTI Aerospace, Inc. (Nasdaq: XTIA) ("XTI"), a pioneer in xVTOL and powered-lift aircraft solutions, announces the selection of the Garmin G700 TXi avionics system for its flagship TriFan 600, the revolutionary xVTOL aircraft for fast, comfortable regional travel.

I rate Garmin a buy with a $294 fair value, driven by strong AI investments and the launch of Connect+ subscription services. Garmin's robust product pipeline, especially in wearables, positions it to capitalize on the healthy living trend and expand market share. The company boasts a strong balance sheet, zero debt, and consistent free cash flow, supporting ongoing innovation and shareholder returns.

Garmin (GRMN) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, GRMN broke through the 20-day moving average, which suggests a short-term bullish trend.

Garmin (GRMN) appears to have found support after losing some value lately, as indicated by the formation of a hammer chart. In addition to this technical chart pattern, strong agreement among Wall Street analysts in revising earnings estimates higher enhances the stock's potential for a turnaround in the near term.

Examine the evolution of Garmin's (GRMN) overseas revenue trends and their effects on Wall Street's forecasts and the stock's prospects.