GTLS Stock Recent News

GTLS LATEST HEADLINES

Chart Industries (GTLS) came out with quarterly earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.84 per share. This compares to earnings of $1.49 per share a year ago.

ATLANTA, May 01, 2025 (GLOBE NEWSWIRE) -- Chart Industries, Inc. (NYSE: GTLS) today reported results for the first quarter 2025 ended March 31, 2025.

Evaluate the expected performance of Chart Industries (GTLS) for the quarter ended March 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Chart Industries (GTLS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Chart Industries' stock plummeted over 90% in fiscal year 2020 due to market panic, but it rebounded as multiyear projects continued unaffected. The acquisition of Howden adds a counter-cyclical repair business. Despite market fears, Chart Industries has not had significant losses from its backlog even in a year like 2020.

Chart Industries (GTLS) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

ATLANTA, April 04, 2025 (GLOBE NEWSWIRE) -- Chart Industries, Inc. (NYSE: GTLS) (“Chart”), a global leader in energy and industrial gas solutions, has scheduled a conference call for Thursday, May 1, 2025 at 8:30 a.m. ET to discuss its first quarter 2025 financial results. Chart plans to issue its first quarter 2025 earnings release prior to market open on May 1st.

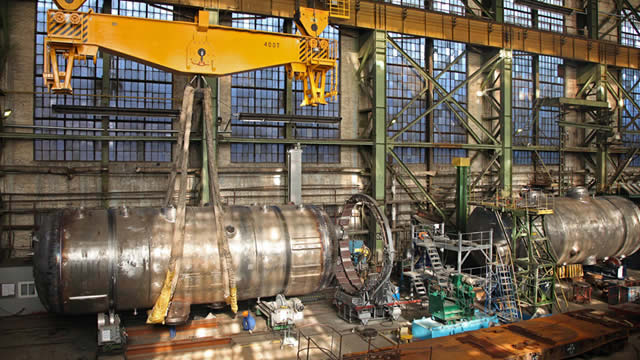

GTLS is set to provide its NRU and helium process technology for the Dry Piney Helium and Carbon Sequestration Project in Sublette County, WY.

ATLANTA, March 11, 2025 (GLOBE NEWSWIRE) -- Chart Industries, Inc. (NYSE: GTLS) (“Chart”), a global leader in energy and industrial gas solutions today announced our selection by Blue Spruce Operating LLC to provide the Nitrogen Rejection Unit (“NRU”) and helium process technology and associated equipment for their Dry Piney Helium and Carbon Sequestration Project to be located in Sublette County, WY.

Chart Industries reported a significant increase of 29.4% in order intake. The fast growth in orders suggests continued strong performance. Investors are particularly interested in the growing backlog.