GWW Stock Recent News

GWW LATEST HEADLINES

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

14 Dividend Kings continue to outperform the S&P 500 in 2025. Dividend growth remains healthy, with one recent increase and a collective 2025 growth rate of 5.23%. Seventeen Dividend Kings currently appear undervalued with strong long-term return potential, using Dividend Yield Theory for valuation.

Investors interested in stocks from the Industrial Services sector have probably already heard of Siemens AG (SIEGY) and W.W. Grainger (GWW).

I track 50 high-quality dividend growth stocks to identify opportune investments, updating valuation ratings daily to focus on attractive opportunities. In this turbulent year, my investable universe kept up with SPY and outperformed SCHD year-to-date, with a gain of 5.63% compared to 5.72% and -2.13%. This month, 18 stocks had valuation rating changes; 5 were upgrades, including Paychex with an attractive expected return.

Dividends can be described as the gift that keeps giving, as dividend stocks can supply you with passive income for years or even decades. The good news is that it's easy to build up a portfolio of dividend stocks with a wide selection of stocks out there, but the key is to select the right ones to own.

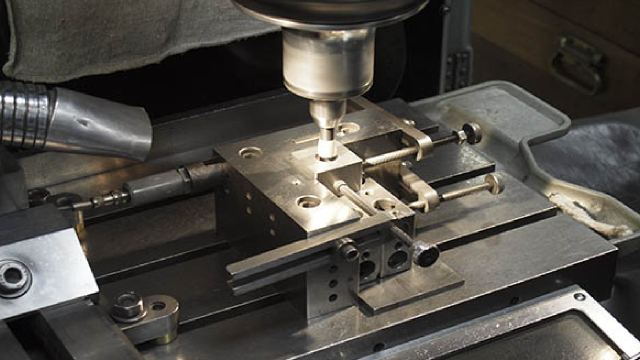

W.W. Grainger is poised for strong growth, leveraging pricing power, scale, and investments in distribution and digital capabilities to outpace the U.S. MRO market. Recent and upcoming price increases, especially in response to tariffs, should boost sales and support margin expansion, with positive customer sentiment and minimal inventory destocking. The Endless Assortment segment is delivering double-digit growth, driven by B2B traction and retention, while reshoring trends support long-term demand for MRO products.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

I track 50 high-quality dividend growth stocks to identify opportune investments, updating valuation ratings daily to focus on attractive opportunities. In this turbulent year, my investable universe outperformed SPY and SCHD year-to-date, with a gain of 2.08% compared to 0.56% and -3.36%. This month, 12 stocks had valuation rating changes; 5 were upgrades, including Ferrari, Pool Corporation and Accenture PLC, all with strong expected returns.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

GWW's strong volume growth and strategic moves in the High-Touch Solutions and Endless Assortment segments make it a smart stock to hold in your portfolio.