HBM Stock Recent News

HBM LATEST HEADLINES

Investors interested in stocks from the Mining - Miscellaneous sector have probably already heard of HudBay Minerals (HBM) and Wheaton Precious Metals Corp. (WPM). But which of these two stocks offers value investors a better bang for their buck right now?

Micron's strong 3Q FY2025 results and upbeat 4Q guidance point to accelerating growth and margin expansion, fueled by surging AI-driven demand for HBM and DRAM. Management raised its FY2025 DRAM bit growth outlook to the high-teens percentage range, up from mid-teens last quarter. Current AI capex and hyperscaler demand support a bullish outlook through FY2026, with HBM growth set to outpace DRAM next year.

HBM, SHBI, NGG, EBMT and GEF have been added to the Zacks Rank #1 (Strong Buy) List on June 30, 2025.

EBMT, HBM and SHBI made it to the Zacks Rank #1 (Strong Buy) value stocks list on June 30, 2025.

The 2023/ 2024 memory demand destruction is well behind us indeed, as observed in MU's robust sequential improvements in FQ3'25 financial performance and the promising FQ4'25 guidance. This is aided by the management's promising commentaries surrounding the recovering consumer demand and the durable multi-year data-center related spending trends. Combined with the HBM3E wins and the ongoing HBM4 sampling, we are likely to see MU deliver outsized growth and a healthier balance sheet over the next few years.

Micron Technology, Inc. stock has surged 58% in 40 days, driven by explosive demand for AI memory solutions like HBM3E. MU's compute and networking segment, powered by HBM, nearly doubled YoY and now drives 88% of operating income. Micron's tech leadership, trusted hyperscaler partnerships, and early HBM4 sampling position it ahead of industry trends.

With MU's HBM supply for 2025 sold out, the spotlight shifts to whether it can scale to meet the soaring demand in 2026.

Bloomberg's Caroline Hyde and Ed Ludlow discuss Micron's earnings as its sales surge in its high-bandwidth memory business. Plus, Managing Director of Baird Ted Mortonson discusses opportunities in the defense tech space.

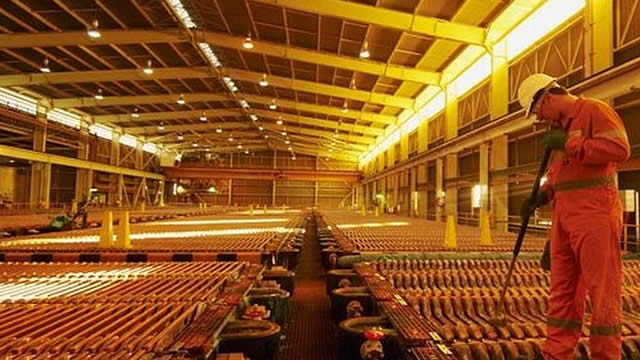

Hudbay Minerals delivers strong Q1 2025 results with record EBITDA, robust free cash flow, and disciplined cost control across diversified copper and gold operations. Operational stability remains intact despite Manitoba wildfire disruptions; management maintains 2025 production guidance and continues to execute growth projects. Gold production and revenue diversification help offset copper price volatility, while Copper Mountain and Copper World offer unpriced long-term upside.

Micron Technology, Inc.'s Q3 FY2025 results beat expectations, with revenue up 36.6% YoY and margins showing recovery, driven by a favorable DRAM/data center mix. NAND revenue grew faster than DRAM QoQ, but pricing remains weak; management is cautious about capacity due to a challenging market environment. Tariff risks appear more contained than previously feared, and AI-driven demand is fueling optimism for continued growth into 2026, especially in HBM.