IDCC Stock Recent News

IDCC LATEST HEADLINES

InterDigital (IDCC) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Five mid-cap AI infrastructure stocks to buy are: INOD, FIVN, PATH, IDCC, AVAV.

Does InterDigital (IDCC) have what it takes to be a top stock pick for momentum investors? Let's find out.

The headline numbers for InterDigital (IDCC) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

InterDigital, Inc. (NASDAQ:IDCC ) Q1 2025 Earnings Conference Call May 1, 2025 10:00 AM ET Company Participants Raiford Garrabrant - Head, Investor Relations Liren Chen - President and CEO Rich Brezski - Chief Financial Officer Conference Call Participants Scott Searle - ROTH Capital Anja Soderstrom - Sidoti Blayne Curtis - Jefferies Arjun Bhatia - William Blair Operator Good morning. And welcome to the First Quarter 2025 Earnings Call.

Despite healthy smartphone licensing momentum, IDCC reports a top-line decline year over year, owing to weakness in the consumer electronics and IoT market.

InterDigital (IDCC) came out with quarterly earnings of $4.21 per share, beating the Zacks Consensus Estimate of $3.72 per share. This compares to earnings of $3.58 per share a year ago.

Revenue, Adjusted EBITDA 2 and EPS above top end of guidance All-time record annualized recurring revenue 4 , up 30% YoY Company reaffirms full year 2025 guidance

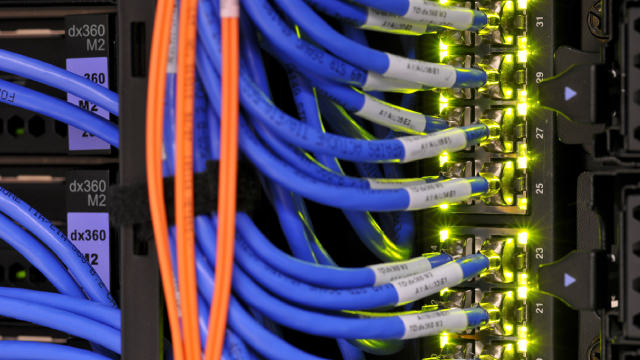

With solid demand for advanced networking architecture for increased broadband usage, the Zacks Wireless Equipment industry is likely to witness healthy growth. ERIC, UI and IDCC are set to thrive despite the near-term challenges.

IDCC is expected to report a top-line contraction year over year in the first quarter of 2025 due to fierce competition and macroeconomic headwinds.