INTC Stock Recent News

INTC LATEST HEADLINES

There is a debate forming between TSMC versus Intel Corporation stock, and we're here to address the chatter. TSMC will continue to own the bulk of the foundry market, but we do see hope for INTC to be a solid second place player in foundry 2.0 with 18A. Our take is that both TSMC and Intel can be winners, over different time frames.

Intel (INTC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Intel (INTC -0.98%) will update investors on its manufacturing expansion and upgrades.

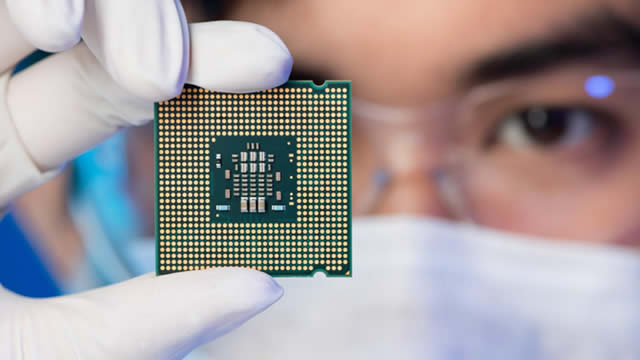

I reiterate my Buy rating on Intel Corporation with a fair value of $29 per share, citing strong progress in AI and GPU product launches. Intel's Computex 2025 event showcased Gaudi 3 AI accelerator and new ARC graphics cards, positioning the company to gain share in AI and workstation markets. Despite near-term revenue headwinds from trade uncertainty and capacity shortages, I expect flat FY25 revenue and 6% organic growth from FY26 onward.

The three major chip stocks in this analysis all look like they are going to give back a little bit of the gains that we saw on Tuesday. This is a market that is still reeling form the announcement that Nvidia can sell chips in China, which caused a big

Intel (INTC -1.59%) has already pulled back on its effort to directly compete with Nvidia in the AI accelerator market. The company's Gaudi line of AI chips held promise, but immature software and an unfamiliar architecture ultimately doomed Intel's flagship AI offerings.

ASML Holding, the microchip-equipment maker that produces the sophisticated machines used to develop semiconductors, caught a broker downgrade just ahead of its second-quarter results.

One of the most reliable gauges of sentiment in the stock market is where growth stocks trade relative to value stocks, since any given extreme can signal above-average optimism or pessimism, creating opportunities for investors to ride a return to balance. Toda's market appears to be driven by extreme optimism, prompting investors to delve deeper into identifying value and potential upside.

QCOM gains edge over INTC in AI PCs and 5G, with stronger 2025 growth forecasts and broader connected tech traction.

Intel layoff notices suggest hundreds of engineers and technicians are among those set to lose their jobs.