IR Stock Recent News

IR LATEST HEADLINES

Although the revenue and EPS for Ingersoll (IR) give a sense of how its business performed in the quarter ended December 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Ingersoll Rand (IR) came out with quarterly earnings of $0.84 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.86 per share a year ago.

DAVIDSON, N.C., Feb. 12, 2025 (GLOBE NEWSWIRE) -- The Board of Directors of Ingersoll Rand Inc. (NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, declared today a regular quarterly cash dividend of $0.02 (two cents) per share of common stock payable on March 27, 2025 to stockholders of record on March 5, 2025.

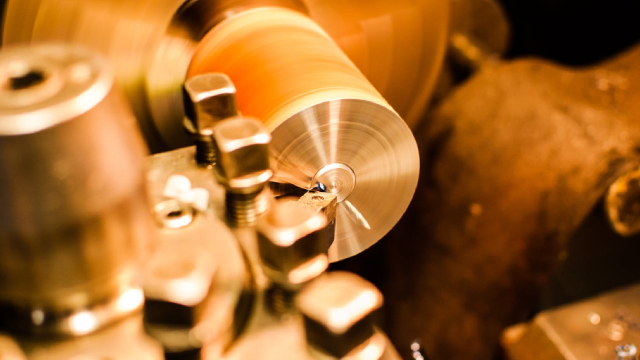

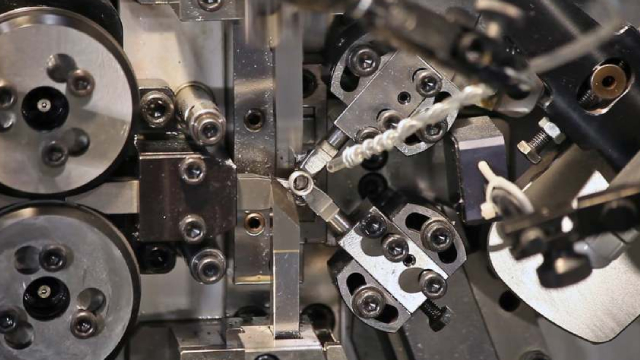

Ingersoll Rand earns “A List” rating from CDP in the environmental stewardship category for the second year in a row Ranked #1 globally in the Machinery and Electrical Equipment industry with a top 1% score on the 2024 S&P Global Corporate Sustainability Assessment and included on the Dow Jones Best-in-Class Indices for the third year in a row Near-term and net-zero Scope 1, 2, and 3 targets approved by the Science Based Targets initiative (SBTi), validating Ingersoll Rand's proposed emission reduction strategy Named to TIME's inaugural list of World's Best Companies in Sustainable Growth DAVIDSON, N.C., Feb. 11, 2025 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc., (NYSE: IR) a global provider of mission-critical flow creation and life science and industrial solutions, continues to demonstrate meaningful progress against its ambitious sustainability strategy and goals with new recognition from CDP, the Dow Jones Best-in-Class Indices (previously the Dow Jones Sustainability Indices), the

DAVIDSON, N.C., Feb. 10, 2025 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc. (NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, announced that Vik Kini, chief financial officer, will participate in fireside chats at the following upcoming investor conferences: The Citi Global Industrial Tech and Mobility Conference on Wednesday, February 19, 2025, at 11:20 a.m.

Ingersoll Rand's fourth-quarter results are likely to gain from strength across the Industrial Technologies & Services and Precision and Science Technologies segments.

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Ingersoll (IR), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended December 2024.

Ingersoll (IR) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

DAVIDSON, N.C., Feb. 03, 2025 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc., (NYSE: IR) a global provider of mission-critical flow creation and life science and industrial solutions, has acquired SSI Aeration, Inc. and its subsidiaries (collectively “SSI”) to extend its capabilities in wastewater treatment.

DAVIDSON, N.C., Jan. 17, 2025 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc. (NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, will issue its fourth quarter 2024 earnings release after the market closes on Thursday, February 13, 2025.