IREN Stock Recent News

IREN LATEST HEADLINES

The increasing acceptance of Bitcoin as a store of value benefits MSTR and IREN. Find out which stock is leading now.

IREN's bitcoin mining surge, AI Cloud growth, and new power projects fuel big stock gains despite valuation risks.

IREN Limited uniquely combines high-margin Bitcoin mining with a strategic shift into green AI data centers, driving impressive 128% YoY growth. Ultra-low energy costs (3.3¢/kWh) provide a major competitive advantage in mining, fueling cash flow for aggressive data center expansion. Valuation appears high on a PS basis, but rapid revenue growth and future data center projects make IREN undervalued long-term.

Every so often, I come across a stock in my research that checks nearly every box I look for: innovation, growth, strong fundamentals, and technical momentum. Iren Limited ( IREN ) is one of those rare finds.

NEW YORK, Aug. 14, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) ("IREN") today announced that it will release its financial results for the fiscal year ended June 30, 2025, on Thursday, August 28, 2025 and host a conference call beginning at 5:00 p.m. Eastern Time.

IREN has surged 210% since April, evolving from a Bitcoin miner to a fast-growing AI infrastructure disruptor. The company funds its AI data center expansion through profitable, low-cost Bitcoin mining, avoiding dilution and debt. Q1 2025 revenue soared 280% year-over-year, with margins and profitability rapidly improving, yet IREN remains undervalued.

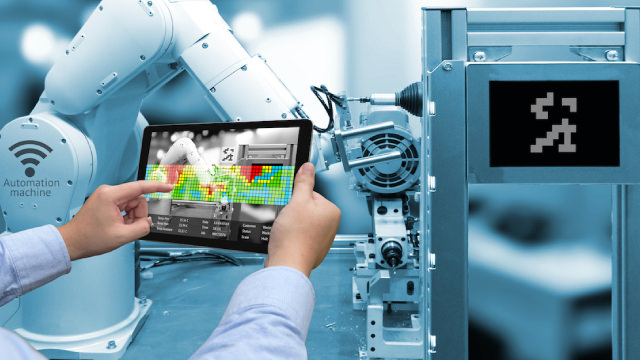

As AI applications scale rapidly and quickly become the norm, powering and deploying this next-gen technology requires serious infrastructure. A new class of companies is emerging as critical enablers of the AI revolution, from purpose-built GPU cloud platforms to energy-efficient data centers and sovereign AI capabilities.

From a technical perspective, IREN Limited (IREN) is looking like an interesting pick, as it just reached a key level of support. IREN recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

NEW YORK, Aug. 06, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”) today published its monthly update for July 2025.

The artificial intelligence industry has been filled with top-performing stocks, but none of them have kept up with Palantir (NASDAQ:PLTR).